Africa Venture Capital and Start-up Funding 2020 – Year End Review

How has start-up funding in Africa faired in 2020?

2020 has been a year like no other. But for business owners, start-up founders and entrepreneurs it is fair to say that their objectives haven’t changed; rather the environment, the means and the opportunity have been augmented. Prior to the publication of our 2020 funding report next year, our team wanted to bring you an early view of how start-up funding in Africa has unfolded this year. So, what did we learn?

For many, this year may be one to forget – COVID-19 has battered industries across the globe, and the personal sacrifice by those working on the front-line as well as the emotional hardship caused through not seeing friends and family has taken its toll. However, 2020 has also been a year of adaptation and resilience. As reported in the Economist, a news service, COVID-19 has dominated the news. While it may be a somewhat flawed gauge of importance, the impact the pandemic will have reached almost every corner of the globe. Part of the reason the coronavirus demands so much attention is the material impact it has had on many facets of daily life.

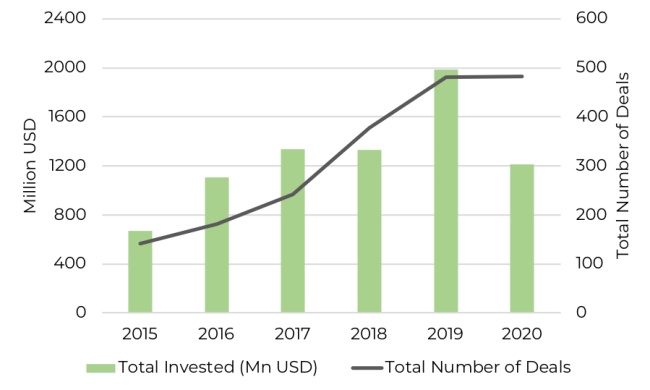

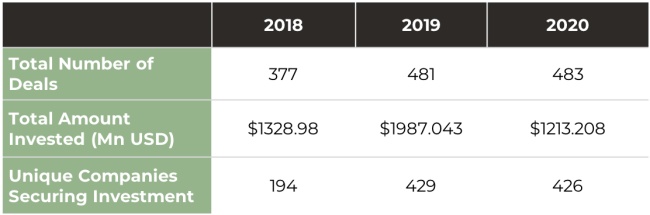

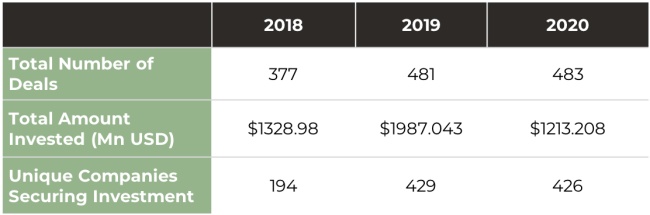

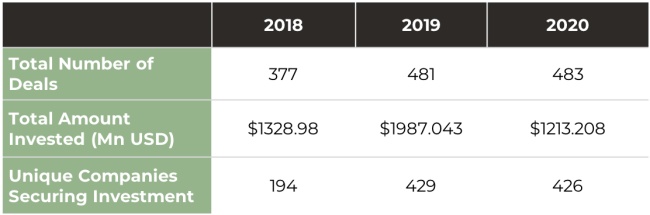

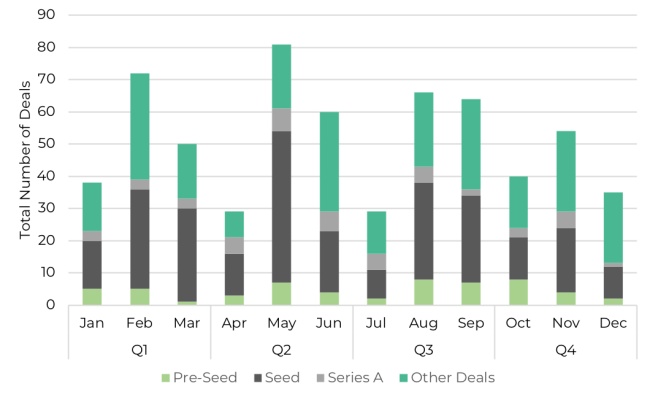

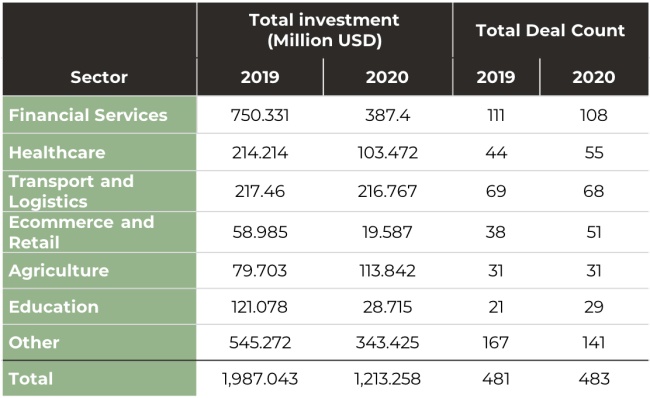

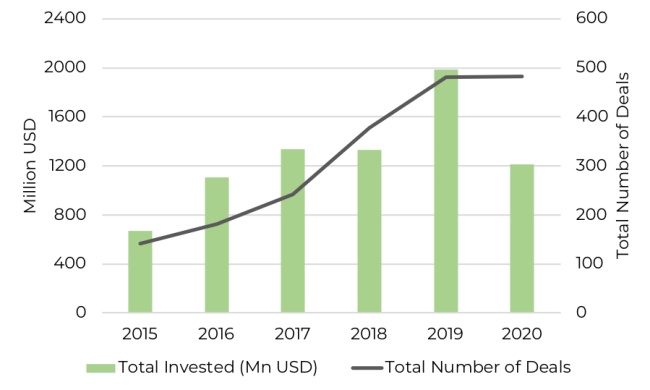

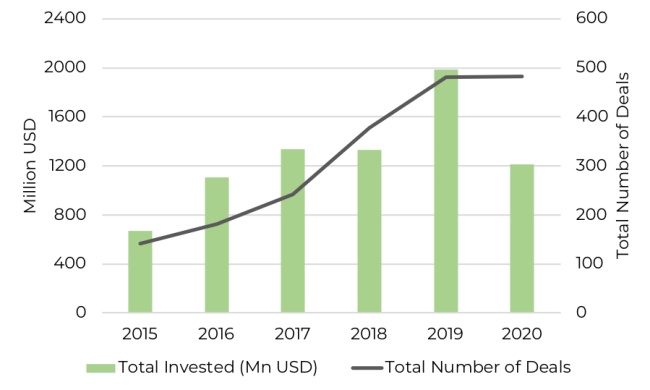

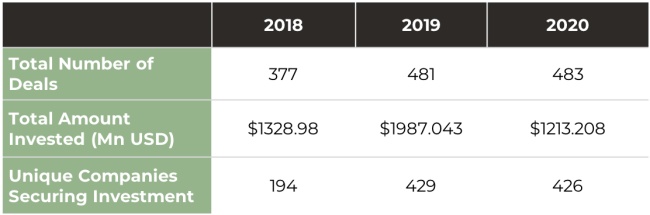

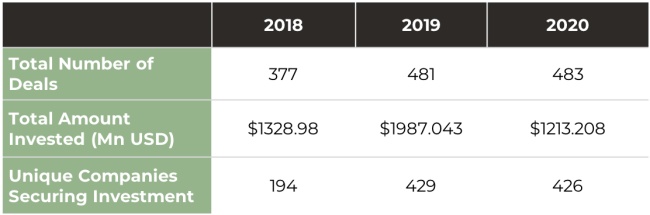

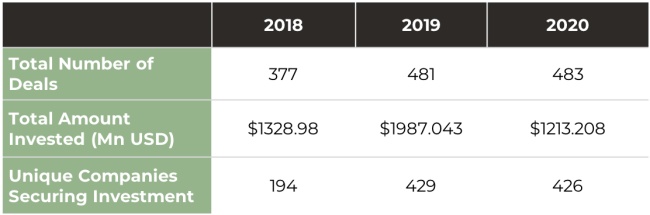

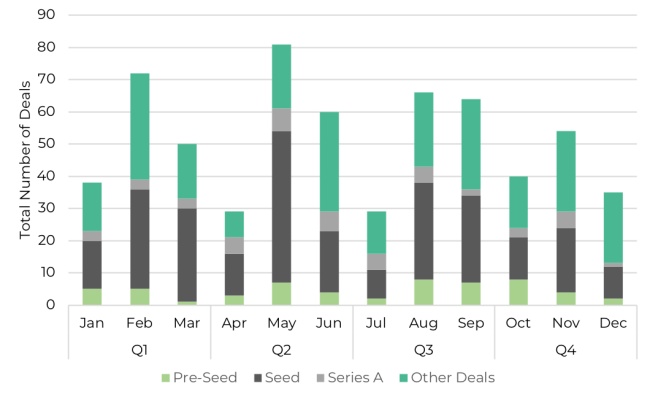

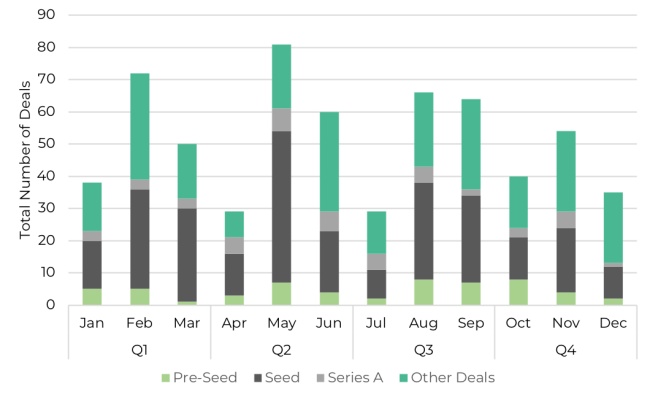

Figure 1: Total Number of deals into technology companies in Africa

Source: Baobab Insights, (2020 year to date as of 17/12/2020)

Working from home and online retail, for example, have been around for decades – however the rate this was adopted into the mainstream throughout 2020 will likely have implications on the role of cities for years to come. For start-up founders, these changes present opportunity. Back in April, we reported on VC investment into Africa’s start-ups over Q1 2020; at a time when businesses were beginning to adjust to a new way of working there was a great deal of uncertainty for the African start-up community. But with Africa’s start-ups continuing to hit the headlines this year, there has also been much to celebrate. So how have things changed since our 2019 funding report?

Has VC Investment Africa increased in 2020?

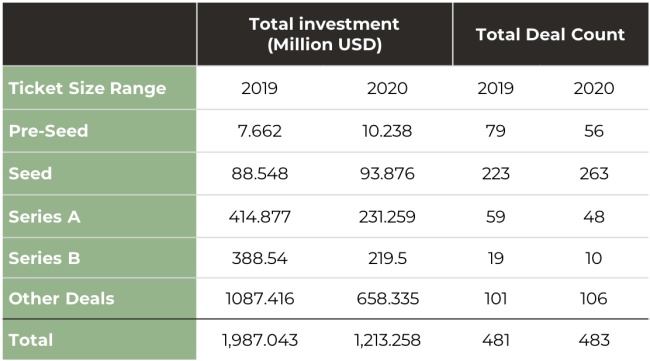

As of 17th December 2020, the total number of deals recorded in 2020 reached 483 (excluding non-equity funding rounds, grants, prizes and M&A). This is slightly above the 2019 figure of 481 funding rounds (figure 1).

Excluding non-equity investment, grants, prizes and M&A, total investment into African start-up’s this year has total $1.213 billion USD. This is some way behind the total recorded in 2019 ($1.987 billion USD) and slightly behind the 2018 total ($1.328 billion USD).

While the amount invested has decreased, the total number of unique companies securing investment has only slightly decreased from 429 in 2019 to 426 in 2020. Perhaps, this reflects some uncertainty in the market, particular earlier on in the year, as investors looked to spread portfolio risk over a larger volume of smaller sized deals.

Source: Baobab Insights, (2020 year to date as of 17/12/2020)

Looking for the next big thing? Find out how Baobab Insights can help your team get access to data and insights from technology markets across Africa:

Speak to our Growth Team

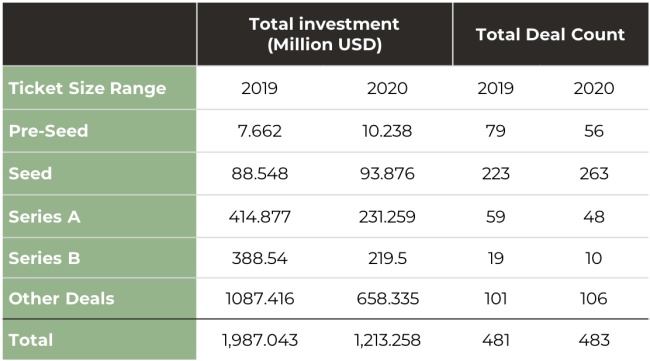

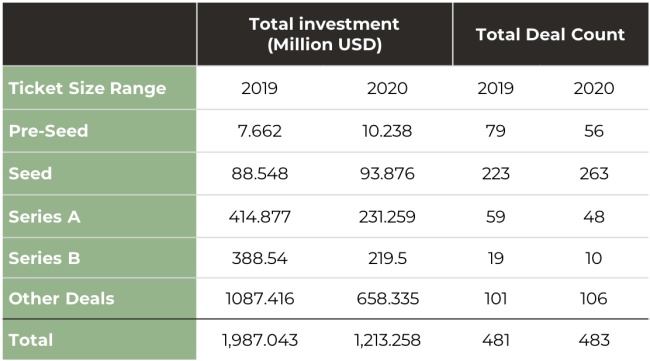

Has the profile of investment changed?

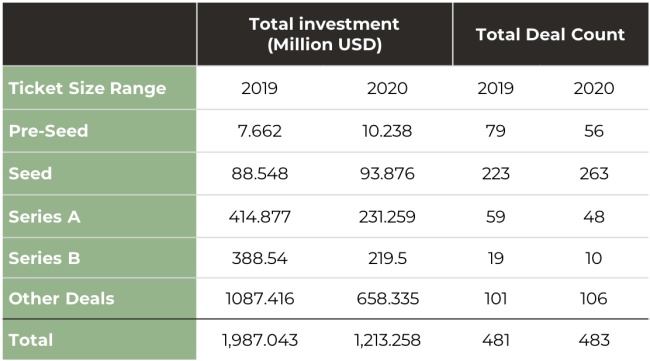

In Q1 2020 pre-seed and seed stage investment made up 54% of the total number of funding rounds. The proportion of seed stage funding rounds fell as a proportion of total funding from 47% of funding in Q1 2020 to 33% in Q4 2020.

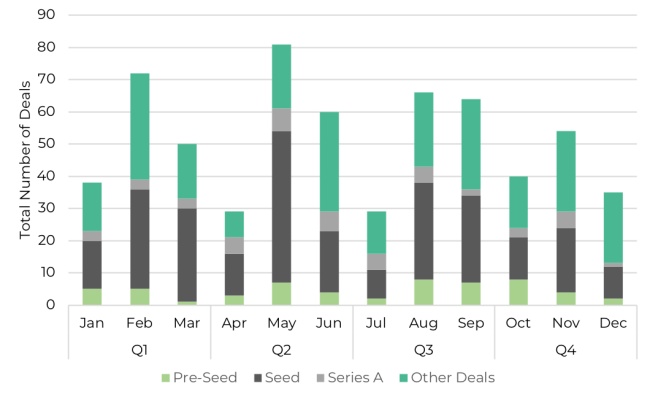

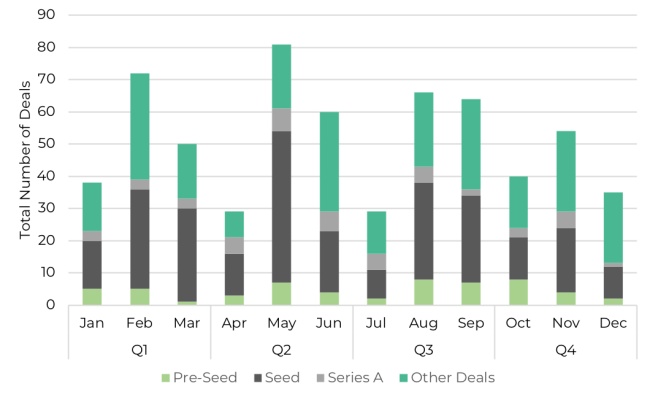

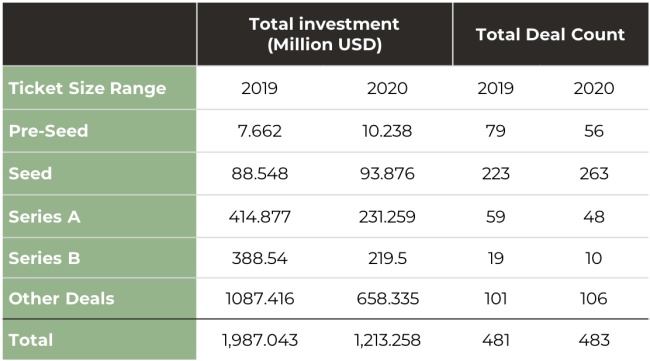

Figure 2: Total Number of deals into technology companies in Africa by stage

Source: Baobab Insights, (2020 year to date as of 17/12/2020)

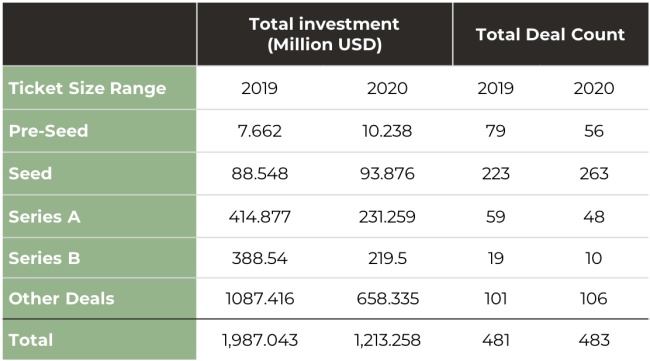

In total the number of pre-seed investment rounds fell from 2019 total of 79 to 56 in 2020, however the number of seed stage funding rounds increased from 223 in 2019 to 263 in 2020.

2020, saw a large increase in the number of grants, prizes and non-equity funding rounds in 2020 from 83 in 2019 to 127 in 2020.

Early-stage venture capital funding, (Series A and Series B) funding saw a decrease from 2019 to 2020; with the number of Series A rounds reducing from 59 in 2019 to 48 in 2020 and Series B rounds reducing from 19 to 10 between 2019 and 2020.

Source: Baobab Insights, (2020 year to date as of 17/12/2020)

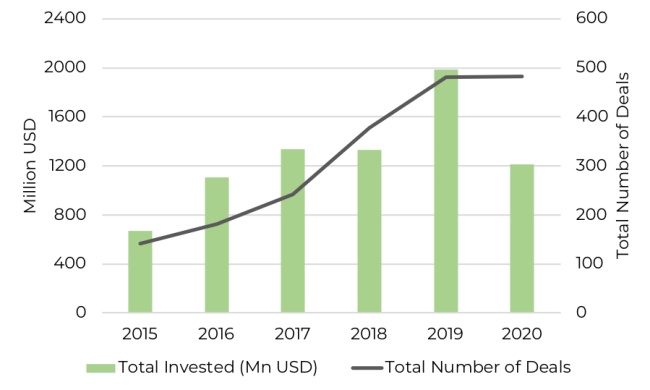

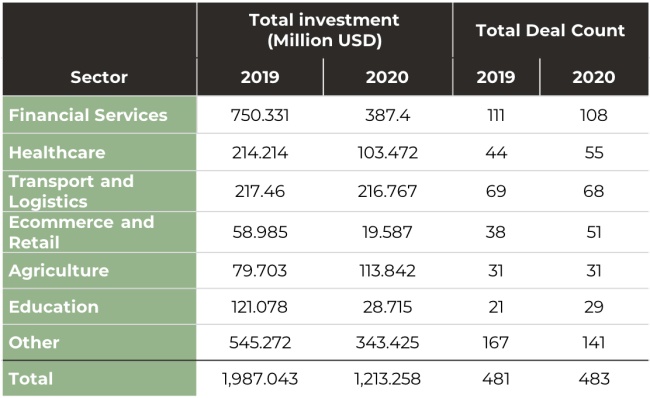

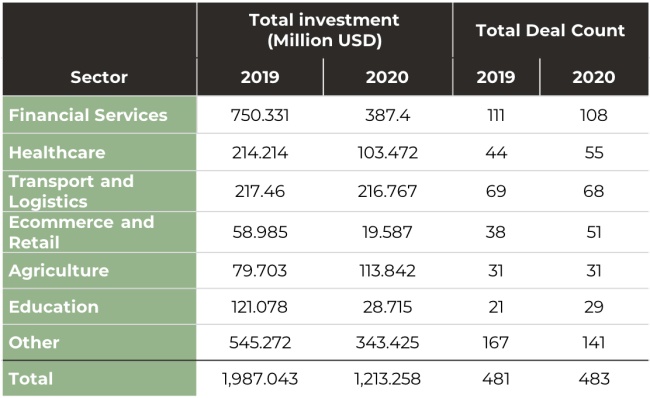

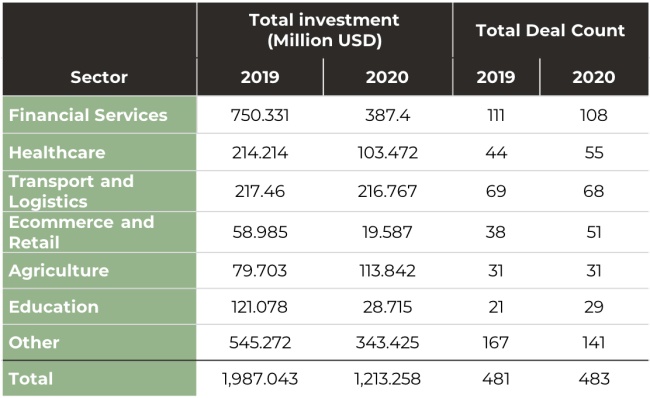

Which Sectors have benefited?

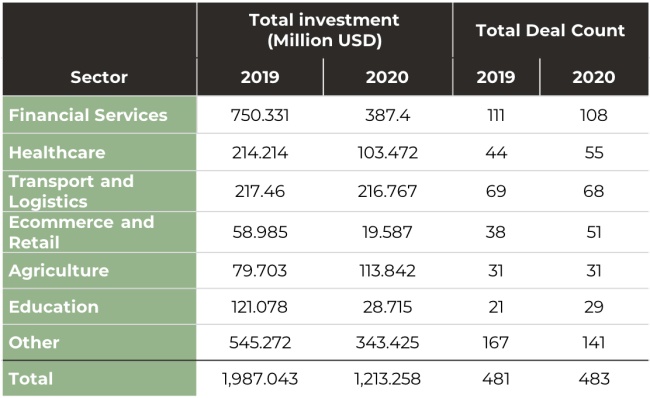

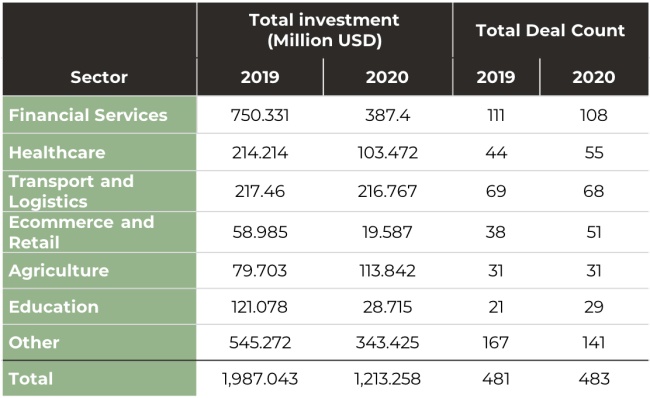

In terms of the number of deals closed per sector, the online retail and healthcare sectors both saw a proportional increase in the amount of funding. Healthcare closed 11% of the number of deals closed in 2020 compared to 9% in 2019, likewise online retail (a big winner in geographies such as the US) saw an increase in the proportion of deals closed from 8% in 2019 to 11% of deals in 2020.

Financial Services (108 deals), Transport and Logistics (68 deals), Healthcare (55 deals), Ecommerce and Retail (51 deals) and Agriculture (31 deals) form the 5 most frequently invested in sectors. However, the 5 sectors attracting the most investment were Financial Services ($387.4 million USD), Transport and Logistics ($216.767 million USD), Energy and Utilities ($191.83 million USD), Agriculture ($113.842 million USD) and Healthcare ($103.472 million USD).

Source: Baobab Insights, (2020 year to date as of 17/12/2020)

What next for start-up founders in Africa?

With many deals still yet to be announced, these figures are more than likely to change. Even with an incomplete picture, it is clear to see that VC investment into African start-ups throughout 2020 saw a movement to earlier stage deals. As consumer behaviours continued to change, we also saw a shift away from FinTech investment into other areas such as e-commerce, B2B logistics and on-demand healthcare models such as online pharmacy and telehealth.

2021 may not bring many answers, but what could have been a catastrophic year can be seen broadly as optimistic for many sectors and geographies. We at The Baobab Network, and the Analyst team at Baobab Insights are, as ever, looking forward to seeing how founders and African technology companies continues to adapt and evolve.

Happy new year, and as always, stay safe.

This article was first published in December 2020, data analysis up to and including 17/12/2020.

Want to find how our data and insight can help you make your next decision? Organise a free trial with our Growth team

Speak to our Growth Team

Africa Venture Capital and Start-up Funding 2020 – Year End Review

How has start-up funding in Africa faired in 2020?

2020 has been a year like no other. But for business owners, start-up founders and entrepreneurs it is fair to say that their objectives haven’t changed; rather the environment, the means and the opportunity have been augmented. Prior to the publication of our 2020 funding report next year, our team wanted to bring you an early view of how VC investment in Africa has unfolded this year. So, what did we learn?

For many, this year may be one to forget – COVID-19 has battered industries across the globe, and the personal sacrifice by those working on the front-line as well as the emotional hardship caused through not seeing friends and family has taken its toll. However, 2020 has also been a year of adaptation and resilience. As reported in the Economist, a news service, COVID-19 has dominated the news. While it may be a somewhat flawed gauge of importance, the impact the pandemic will have reached almost every corner of the globe. Part of the reason the coronavirus demands so much attention is the material impact it has had on many facets of daily life.

Figure 1: Total Number of deals into technology companies in Africa

Source: Baobab Insights, (2020 year to date as of 17/12/2020)

Working from home and online retail, for example, have been around for decades – however the rate this was adopted into the mainstream throughout 2020 will likely have implications on the role of cities for years to come. For start-up founders, these changes present opportunity. Back in April, we reported on VC investment into Africa’s start-ups over Q1 2020; at a time when businesses were beginning to adjust to a new way of working there was a great deal of uncertainty for the African start-up community. But with Africa’s start-ups continuing to hit the headlines this year, there has also been much to celebrate. So how have things changed since our 2019 funding report?

Has VC Investment Africa increased in 2020?

As of 17th December 2020, the total number of deals recorded in 2020 reached 483 (excluding non-equity funding rounds, grants, prizes and M&A). This is slightly above the 2019 figure of 481 funding rounds (figure 1).

Excluding non-equity investment, grants, prizes and M&A, total investment into African start-up’s this year has total $1.213 billion USD. This is some way behind the total recorded in 2019 ($1.987 billion USD) and slightly behind the 2018 total ($1.328 billion USD).

While the amount invested has decreased, the total number of unique companies securing investment has only slightly decreased from 429 in 2019 to 426 in 2020. Perhaps, this reflects some uncertainty in the market, particular earlier on in the year, as investors looked to spread portfolio risk over a larger volume of smaller sized deals.

Source: Baobab Insights, (2020 year to date as of 17/12/2020)

Looking for the next big thing? Find out how Baobab Insights can help your team get access to data and insights from technology markets across Africa:

Speak to our Growth Team

Has the profile of investment changed?

In Q1 2020 pre-seed and seed stage investment made up 54% of the total number of funding rounds. The proportion of seed stage funding rounds fell as a proportion of total funding from 47% of funding in Q1 2020 to 33% in Q4 2020.

Figure 2: Total Number of deals into technology companies in Africa by stage

Source: Baobab Insights, (2020 year to date as of 17/12/2020)

In total the number of pre-seed investment rounds fell from 2019 total of 79 to 56 in 2020, however the number of seed stage funding rounds increased from 223 in 2019 to 263 in 2020.

2020, saw a large increase in the number of grants, prizes and non-equity funding rounds in 2020 from 83 in 2019 to 127 in 2020.

Early-stage venture capital funding, (Series A and Series B) funding saw a decrease from 2019 to 2020; with the number of Series A rounds reducing from 59 in 2019 to 48 in 2020 and Series B rounds reducing from 19 to 10 between 2019 and 2020.

Source: Baobab Insights, (2020 year to date as of 17/12/2020)

Which Sectors have benefited?

In terms of the number of deals closed per sector, the online retail and healthcare sectors both saw a proportional increase in the amount of funding. Healthcare closed 11% of the number of deals closed in 2020 compared to 9% in 2019, likewise online retail (a big winner in geographies such as the US) saw an increase in the proportion of deals closed from 8% in 2019 to 11% of deals in 2020.

Financial Services (108 deals), Transport and Logistics (68 deals), Healthcare (55 deals), Ecommerce and Retail (51 deals) and Agriculture (31 deals) form the 5 most frequently invested in sectors. However, the 5 sectors attracting the most investment were Financial Services ($387.4 million USD), Transport and Logistics ($216.767 million USD), Energy and Utilities ($191.83 million USD), Agriculture ($113.842 million USD) and Healthcare ($103.472 million USD).

Source: Baobab Insights, (2020 year to date as of 17/12/2020)

What next for start-up founders in Africa?

With many deals still yet to be announced, these figures are more than likely to change. Even with an incomplete picture, it is clear to see that VC investment into African start-ups throughout 2020 saw a movement to earlier stage deals. As consumer behaviours continued to change, we also saw a shift away from FinTech investment into other areas such as e-commerce, B2B logistics and on-demand healthcare models such as online pharmacy and telehealth.

2021 may not bring many answers, but what could have been a catastrophic year can be seen broadly as optimistic for many sectors and geographies. We at The Baobab Network, and the Analyst team at Baobab Insights are, as ever, looking forward to seeing how founders and African technology companies continues to adapt and evolve.

Happy new year, and as always, stay safe.

This article was first published in December 2020, data analysis up to and including 17/12/2020.

Want to find how our data and insight can help you make your next decision? Organise a free trial with our Growth team