Baobab Developments: 2020 Africa Venture Capital and Start-up Investment Report

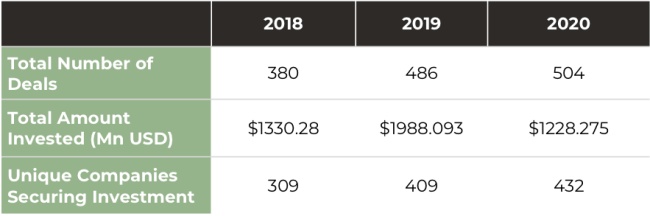

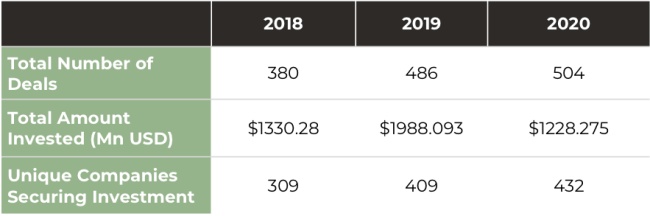

2020 will be remembered as a year like no other. As Governments began to lock down cities and countries around the globe, it felt for a while like everything was placed on pause. Following on from our preview report published at the end of December 2020, start-ups in Africa closed out 2020 in a far stronger position than could have been predicted, with the total number of VC deals increasing from a 2019 total of 486 to 504.

In this report, we take a closer look at some of the key themes and trends from 2020.

Headlines from the 2020 Africa Venture Capital and Start-up Investment Report:

- The total amount invested in 2020 reached $1.228 billion USD across 504 deals, a decrease from the 2019 total of $1.988 billion across 486 deals.

- FinTech continued to attract the most investment in terms of deals (increasing from 112 in 2019 to 115 in 2019) and amount invested (decreasing from $750.4 million USD in 2019 to $391.7 million USD in 2020). However, with services moving online in response to the COVID-19 pandemic, healthcare technology, education and e-commerce sectors also saw an increase in their share of deals (28.9%, 42.9% and 36.8% increases respectively from 2019 to 2020).

- Angel and Seed stage funding saw the largest increase in the number of deals announced (increasing from 306 to 340 deals between 2019 and 2020), both early and late-stage investment both decreased in terms of the number of deals (combined total of 99 in 2019 decreasing to 70 in 2020) and the amount raised (decreasing from a combined total of $1.55 billion USD in 2019 to $632.6 million USD in 2020).

Africa start-up investment data from 2018 to 2020

This report was first published in January 2021.

Download full 16 pages 2021 Africa venture capital Development report in PDF

Download 16 Page Report

Baobab Developments: 2020 Africa Venture Capital and Start-up Investment Report

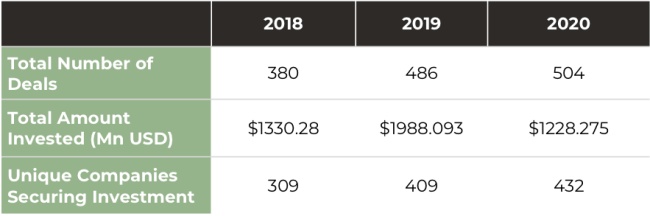

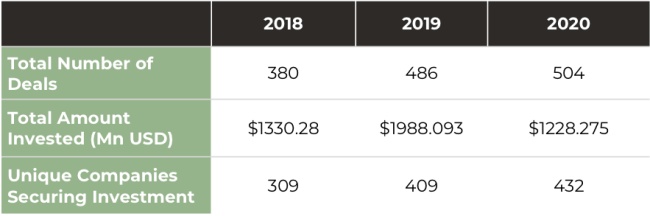

2020 will be remembered as a year like no other. As Governments began to lock down cities and countries around the globe, it felt for a while like everything was placed on pause. Following on from our preview report published at the end of December 2020, start-ups in Africa closed out 2020 in a far stronger position than could have been predicted, with the total number of VC deals increasing from a 2019 total of 486 to 504.

In this report, we take a closer look at some of the key themes and trends from 2020.

Headlines from the 2020 Africa Venture Capital and Start-up Investment Report:

- The total amount invested in 2020 reached $1.228 billion USD across 504 deals, a decrease from the 2019 total of $1.988 billion across 486 deals.

- FinTech continued to attract the most investment in terms of deals (increasing from 112 in 2019 to 115 in 2019) and amount invested (decreasing from $750.4 million USD in 2019 to $391.7 million USD in 2020). However, with services moving online in response to the COVID-19 pandemic, healthcare technology, education and e-commerce sectors also saw an increase in their share of deals (28.9%, 42.9% and 36.8% increases respectively from 2019 to 2020).

- Angel and Seed stage funding saw the largest increase in the number of deals announced (increasing from 306 to 340 deals between 2019 and 2020), both early and late-stage investment both decreased in terms of the number of deals (combined total of 99 in 2019 decreasing to 70 in 2020) and the amount raised (decreasing from a combined total of $1.55 billion USD in 2019 to $632.6 million USD in 2020).

Africa start-up investment data from 2018 to 2020

This report was first published in January 2021.

Download full 16 pages 2021 Africa venture capital Development report in PDF

Download 16 Page Report