New Technology Developments: Product Launches and Regional Expansion in January 2021

Last week our 2020 Technology Funding Report hit your inboxes (following our free teaser in December 2020). The number of unique companies securing investment in 2020 reached an all-time high (432 companies, up from 409 in 2019). But has 2021 started off on the same foot? In this tech round-up we take a look at the new product launches and market expansions announced in January 2021 to find out.

Technology roundup – are 2020 trends continuing into 2021?

Are we missing anyone?

Submit Company Announcment

2020 saw a shift to digital, as traditionally offline services moved online; a trend which was also reflected in our end of year funding analysis (and free preview report released in December 2020). Healthcare technology, education and e-commerce sectors all saw an increase in the number of deals (28.9%, 42.9% and 36.8% increases respectively from 2019 to 2020). This trend seems to have continued into the new year, with 50% of new product launches falling within these three sectors.

For example, Play Communications, a technology group based in Europe specialising in mobile communications services, announced the launch of their healthcare app in Kenya called Zuri Health. This app connects patients with healthcare professionals to enable them to book appointments, access laboratory tests as well as schedule telehealth services.

Healthcare start-up Aweza, also announced the launch of AwezaMed following the conclusion of a clinical trial run in conjunction with the Council for Scientific and Industrial Research (CSIR). AwezaMed is a Healthcare technology solution which translates medical texts into 11 local languages across South Africa. The plugin provides the ability to access bilingual translations by simply by clicking on selected words.

2020 also saw increased investor activity in the agriculture sector; the total sum invested increased 53.6% year-on-year from $79.703m in 2019, to $122.392 in 2020. January 2021 has seen continued activity in this sector; South-African based start-up, Nile for example, announced the launch of their supply chain tool. Their solution connects fresh produce buyers directly to sellers by providing a platform for direct and secure transactions.

This month we saw also Nigerian-based start-up Rimotli Technologies and South-African based start-up Legal Lens both launching digital platforms to make legal services more accessible and affordable.

January 2021 Market Expansion and Regional Growth

Are we missing anyone?

Submit Company Announcment

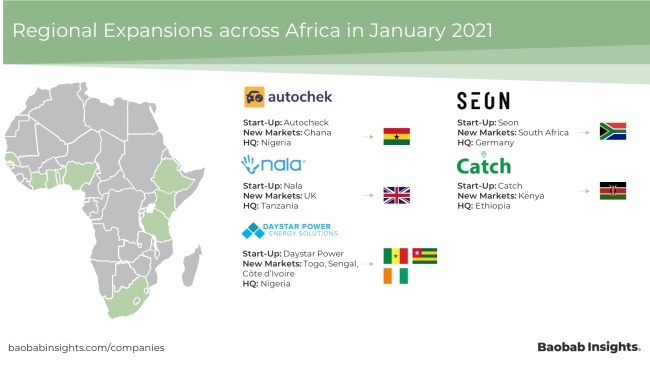

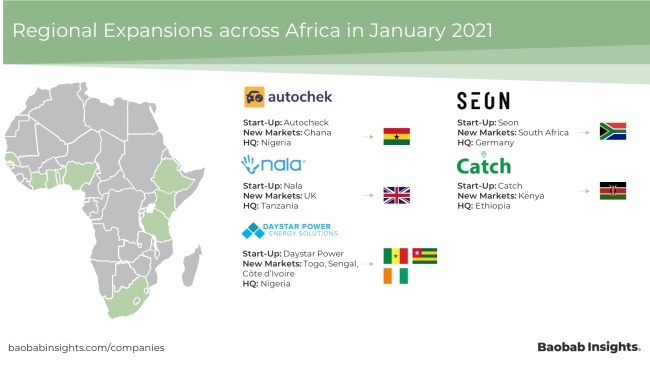

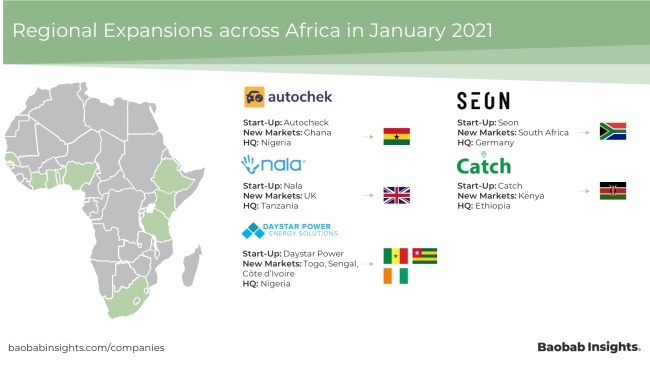

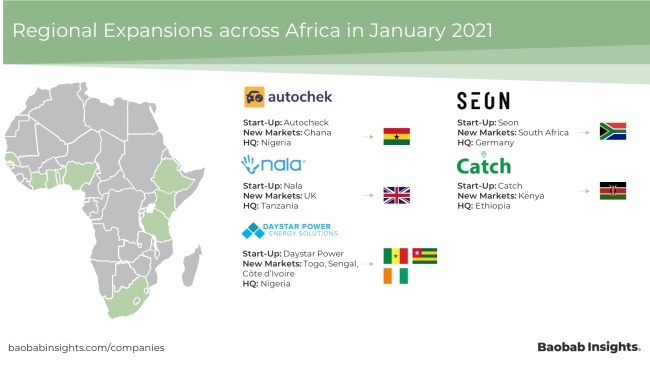

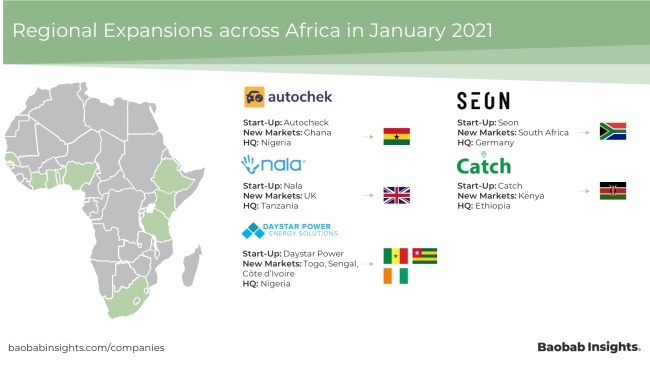

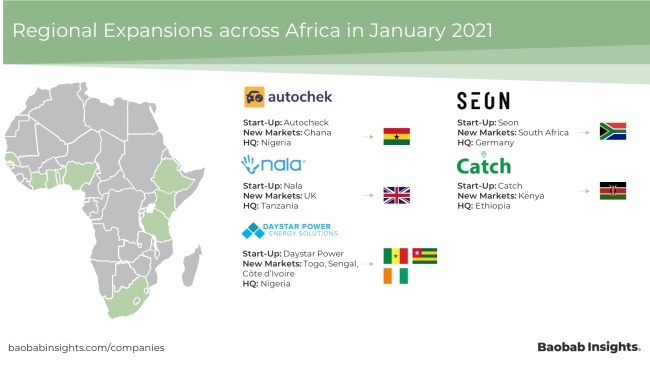

Throughout 2020, founders and businesses had to continually adapt to measures put in place in response to COVID-19. As such, we saw a number of examples of plans for international expansion either paused or temporarily suspended (for example Twiga Foods in August 2020). In a positive start to the year, January 2021 has already seen a number of companies announce regional growth plans. German home security firm SEON closed a R-55 million ZAR funding round to support their growth in South Africa. Additionally, Tanzania based micro-lending platform Nala announced they are expanding operations into the United Kingdom by offering money-transfer services.

Daystar Power, who hit the headlines following their $38 million USD Series B investment from the Investment Fund for Developing Countries (IFU), and Morgan Stanley Investment Management, announced plans for regional expansion into Togo.

Following a successful product launch in June 2020, Ethiopian mobility start-up Catch announced they intend on expanding operations in Nairobi, Kenya. In a recent interview the company expressed their plans to expand into another five African countries in 2021 as well as launch further new products and services.

While it is clear that the coronavirus (COVID-19) pandemic is still responsible for much uncertainty in the market, January 2021 serves to highlight the adaptability and resilience of technology companies across Africa.

FREE ACCESS: Download Product Developments and Regional Expansions: Africa Market Map

Download Market Map

FREE ACCESS: Download Product Developments and Regional Expansions: Africa Market Map

Download Market Map

Contact the authors for more information about our Insight

New Technology Developments: Product Launches and Regional Expansion in January 2021

Last week our 2020 Technology Funding Report hit your inboxes (following our free teaser in December 2020). The number of unique companies securing investment in 2020 reached an all-time high (432 companies, up from 409 in 2019). But has 2021 started off on the same foot? In this tech round-up we take a look at the new product launches and market expansions announced in January 2021 to find out.

Technology roundup – are 2020 trends continuing into 2021?

2020 saw a shift to digital, as traditionally offline services moved online; a trend which was also reflected in our end of year funding analysis (and free preview report released in December 2020). Healthcare technology, education and e-commerce sectors all saw an increase in the number of deals (28.9%, 42.9% and 36.8% increases respectively from 2019 to 2020). This trend seems to have continued into the new year, with 50% of new product launches falling within these three sectors.

For example, Play Communications, a technology group based in Europe specialising in mobile communications services, announced the launch of their healthcare app in Kenya called Zuri Health. This app connects patients with healthcare professionals to enable them to book appointments, access laboratory tests as well as schedule telehealth services.

Healthcare start-up Aweza, also announced the launch of AwezaMed following the conclusion of a clinical trial run in conjunction with the Council for Scientific and Industrial Research (CSIR). AwezaMed is a Healthcare technology solution which translates medical texts into 11 local languages across South Africa. The plugin provides the ability to access bilingual translations by simply by clicking on selected words.

2020 also saw increased investor activity in the agriculture sector; with the total sum invested increased 53.6% year-on-year from $79.703m in 2019, to $122.392 in 2020. January 2021 has seen continued activity in this sector; South-African based start-up, Nile for example, announced the launch of their supply chain tool. Their solution connects fresh produce buyers directly to sellers by providing a platform for direct and secure transactions.

This month we saw also Nigerian-based start-up Rimotli Technologies and South-African based start-up Legal Lens both launching digital platforms to make legal services more accessible and affordable.

January 2021 Market Expansion and Regional Growth

Throughout 2020, founders and businesses had to continually adapt to measures put in place in response to COVID-19. As such, we saw a number of examples of plans for international expansion either paused or temporarily suspended (for example Twiga Foods in August 2020). In a positive start to the year, January 2021 has already seen a number of companies announce regional growth plans. German home security firm SEON closed a R-55 million ZAR funding round to support their growth in South Africa. Additionally, Tanzania based micro-lending platform Nala announced they are expanding operations into the United Kingdom by offering money-transfer services.

Daystar Power, who hit the headlines following their $38 million USD with the support the Investment Fund for Developing Countries (IFU), and Morgan Stanley Investment Management, they announced plans for regional expansion into Togo.

Following a successful product launch in June 2020, Ethiopian mobility start-up Catch announced they intend on expanding operations in Nairobi, Kenya. In a recent interview the company expressed their plans to expand into another five African countries in 2021 as well as launch further new products and services.

While it is clear that the coronavirus (COVID-19) pandemic is still responsible for much uncertainty in the market, January 2021 serves to highlight the adaptability and resilience of technology companies across Africa.