60 Cryptocurrency-Enabled FinTech’s – Africa Market Map

If you don’t know your Ethereum from your Litecoin you might have missed a couple of big news stories developing in the world of cryptocurrency. Bitcoin, a cryptocurrency launched in 2008, reached a record high price against the US dollar earlier this year, on the 9th January one coin would cost you $40,257 USD. This rise has been rapid; on the 1st January 2020 one Bitcoin cost $7,200.17 USD, just a year later, the price of 1 Bitcoin on the 1st January 2021 was $32,203.64 USD.

When news broke last year that South Africa cryptocurrency trading platform Luno was acquired by Digital Currency Group for an undisclosed sum, it is fair to say that cryptocurrencies had well and truly grown from out of the remit of speculators and early adopters and into the mainstream. In what may well be a watershed moment for cryptocurrency, Tesla announced via an SEC filing on the 8th February 2020 that it had bought $1.5 billion USD of Bitcoin. Additionally, the company announced that it was keen to begin accepting bitcoin as a form of payment for its products.

Source: Cryptocompare

This is creating a problem for central banks. In a white paper released in 2017, at the time of the last Bitcoin bubble, the Central Bank of Nigeria (CBN) informed all financial institutions that the use of cryptocurrencies was forbidden given that they were issued by unregulated and unlicensed entities. On 7th February 2021, the CBN again sent a letter to financial institutions ordering them to shut down all bank accounts associated with cryptocurrency trading platforms. Platforms such as trading platform Binance, and payments application Bundle ceased some operations, much to the anger and confusion of their customers.

But according to a report published by Chainalysis, a research group, emerging markets across Africa, Asia and South America are driving retail cryptocurrency adoption. While it is likely that interest is being driven by speculators, there is also an argument that many users are drawn to cryptocurrencies to effectively mitigate against unstable economic conditions. According to data provider Statista, the number of cryptocurrency wallets has grown from 3 million in February 2015 to 66 million as of February 2021.

Cryptocurrency adoption in Africa

In early February 2021, OVEX, a South-African based cryptocurrency exchange raised an undisclosed venture round led by Alameda Research, who joins earlier investors including Newtown Partners and Invictus Capital in backing the companies vision. Given the increasing interest into cryptocurrency, we decided to dig into our databases and map out the landscape across Africa.

Source: Baobab Insights

Source: Baobab Insights

Are we missing anyone?

Submit Startup

We mapped out a total of 60 active cryptocurrency exchanges platforms operating across Africa covering by peer-to-peer transactions (such as Luno) and trade financing exchanges such as Bitpesa. In total 43% of the companies are headquartered in Nigeria followed by South Africa (18%) and Kenya (11%).

From our deals database, we found that a total of $94.976 million USD of disclosed investment had been secured by companies providing cryptocurrency exchange services. What was striking was that despite Nigeria boasting the largest proportion of company HQ’s, when we looked at funding per region this did not necessarily directly correlate.

Our funding data showed that East Africa had received $42.485 million of the total funding, followed by Southern Africa ($28.225 million) and West Africa ($24.201). It is worth noting this trend is largely a reflection of the sizeable funding rounds East-African headquartered BitPesa ($10 million) and CoinFlex ($15 million), both rounds closing in 2019.

Will we see a repeat of the 2017 bull-run in 2021?

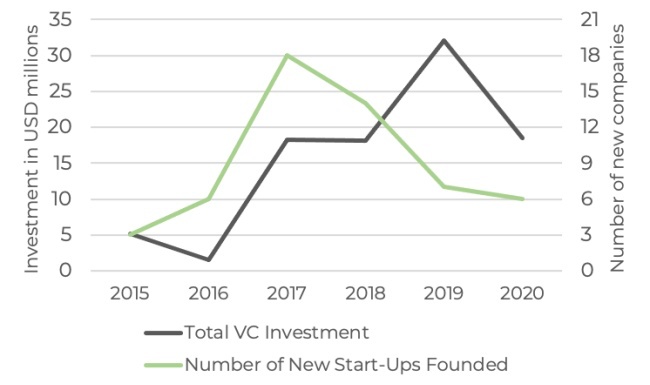

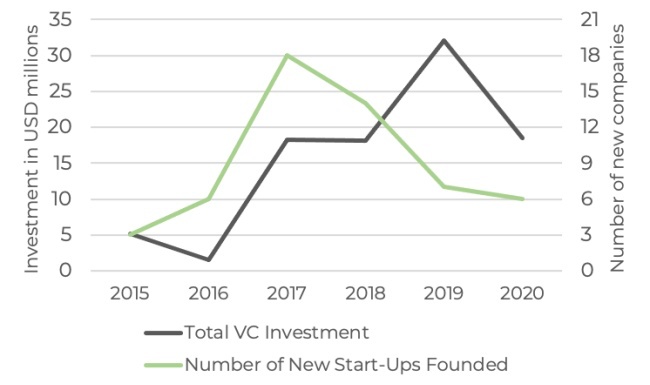

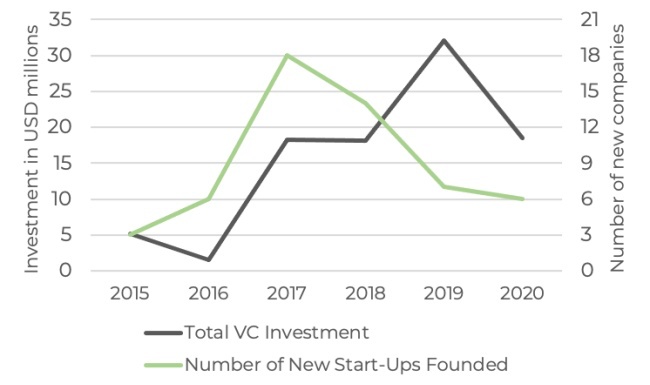

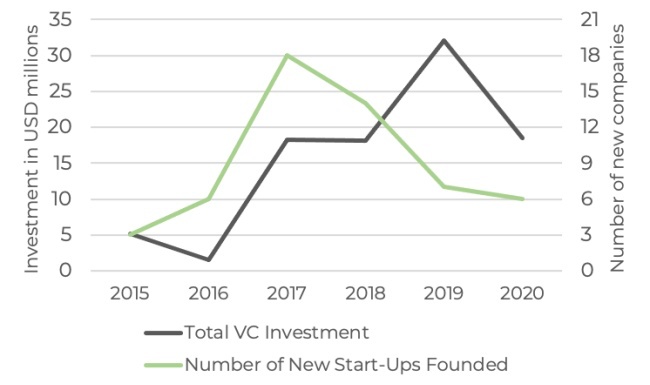

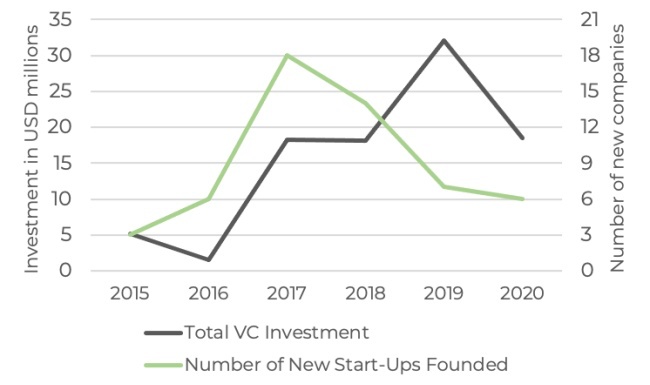

Figure 1: Graph Showing Investment into Cryptocurrency-Enabled Companies vs Year Founded since 2015

Source: Baobab Insights

In 2017, Bitcoin experienced a historic rise in price, increasing from $900 USD per coin to $20,000 USD per coin. Likened to the tulip trading bubble of the 17th century the price quickly came down after the bubble burst. However, the resulting media interest has perhaps had a more long-term impact.

Over half of all companies featured in our market map who provide cryptocurrency exchange services were founded between 2017 and 2018. While other factors may well have contributed to this, it seems likely that the media interest and excitement around cryptocurrencies future in 2017 inspired many founders to move into the space and tap into the growing market opportunity. This spike in start-up activity was in turn followed by increased levels of investment as companies secured their positions in the market, reaching its height in 2019.

Historic pricing analysis of Bitcoin shows that a bull-run, where investors suddenly pile into an investment opportunity due to a fear of missing out, seems to occur every four years. Four years on from the 2017 rush we find ourselves with Bitcoin’s price increasing 40% in the first week of 2021 alone. While it is more than likely that Bitcoin’s bubble will burst at some point in the future, perhaps the resulting media interest will further drag cryptocurrency into the mainstream.

FREE ACCESS: Download 60 Cryptocurrency-Enabled FinTech: Africa Market Map

Download Market Map

FREE ACCESS: Download 60 Cryptocurrency-Enabled FinTech: Africa Market Map

Download Market Map

Contact the authors for more information about our Insight

60 Cryptocurrency-Enabled FinTech’s – Africa Market Map

If you don’t know your Ethereum from your Litecoin you might have missed a couple of big news stories developing in the world of cryptocurrency. Bitcoin, a cryptocurrency launched in 2008, reached a record high price against the US dollar earlier this year, on the 9th January one coin would cost you $40,257 USD. This rise has been rapid; on the 1st January 2020 one Bitcoin cost $7,200.17 USD, just a year later, the price of 1 Bitcoin on the 1st January 2021 was $32,203.64 USD.

When news broke last year that South Africa cryptocurrency trading platform Luno was acquired by Digital Currency Group for an undisclosed sum, it is fair to say that cryptocurrencies had well and truly grown from out of the remit of speculators and early adopters and into the mainstream. In what may well be a watershed moment for cryptocurrency, Tesla announced via an SEC filing on the 8th February 2020 that it had bought $1.5 billion USD of Bitcoin. Additionally, the company announced that it was keen to begin accepting bitcoin as a form of payment for its products.

Source: Cryptocompare

This is creating a problem for central banks. In a white paper released in 2017, at the time of the last Bitcoin bubble, the Central Bank of Nigeria (CBN) informed all financial institutions that the use of cryptocurrencies was forbidden given that they were issued by unregulated and unlicensed entities. On 7th February 2021, the CBN again sent a letter to financial institutions ordering them to shut down all bank accounts associated with cryptocurrency trading platforms. Platforms such as trading platform Binance, and payments application Bundle ceased some operations, much to the anger and confusion of their customers.

But according to a report published by Chainalysis, a research group, emerging markets across Africa, Asia and South America are driving retail cryptocurrency adoption. While it is likely that interest is being driven by speculators, there is also an argument that many users are drawn to cryptocurrencies to effectively mitigate against unstable economic conditions. According to data provider Statista, the number of cryptocurrency wallets has grown from 3 million in February 2015 to 66 million as of February 2021.

Cryptocurrency adoption in Africa

In early February 2021, OVEX, a South-African based cryptocurrency exchange raised an undisclosed venture round led by Alameda Research, who joins earlier investors including Newtown Partners and Invictus Capital in backing the companies vision. Given the increasing interest into cryptocurrency, we decided to dig into our databases and map out the landscape across Africa.

Are we missing anyone?

Submit Startup

We mapped out a total of 60 active cryptocurrency exchanges platforms operating across Africa covering by peer-to-peer transactions (such as Luno) and trade financing exchanges such as Bitpesa. In total 43% of the companies are headquartered in Nigeria followed by South Africa (18%) and Kenya (11%).

From our deals database, we found that a total of $94.976 million USD of disclosed investment had been secured by companies providing cryptocurrency exchange services. What was striking was that despite Nigeria boasting the largest proportion of company HQ’s, when we looked at funding per region this did not necessarily directly correlate.

Our funding data showed that East Africa had received $42.485 million of the total funding, followed by Southern Africa ($28.225 million) and West Africa ($24.201). It is worth noting this trend is largely a reflection of the sizeable funding rounds East-African headquartered BitPesa ($10 million) and CoinFlex ($15 million), both rounds closing in 2019.

Will we see a repeat of the 2017 bull-run in 2021?

Figure 1: Graph Showing Investment into Cryptocurrency-Enabled Companies vs Year Founded since 2015

Source: Baobab Insights

In 2017, Bitcoin experienced a historic rise in price, increasing from $900 USD per coin to $20,000 USD per coin. Likened to the tulip trading bubble of the 17th century the price quickly came down after the bubble burst. However, the resulting media interest has perhaps had a more long-term impact.

Over half of all companies featured in our market map who provide cryptocurrency exchange services were founded between 2017 and 2018. While other factors may well have contributed to this, it seems likely that the media interest and excitement around cryptocurrencies future in 2017 inspired many founders to move into the space and tap into the growing market opportunity. This spike in start-up activity was in turn followed by increased levels of investment as companies secured their positions in the market, reaching its height in 2019.

Historic pricing analysis of Bitcoin shows that a bull-run, where investors suddenly pile into an investment opportunity due to a fear of missing out, seems to occur every four years. Four years on from the 2017 rush we find ourselves with Bitcoin’s price increasing 40% in the first week of 2021 alone. While it is more than likely that Bitcoin’s bubble will burst at some point in the future, perhaps the resulting media interest will further drag cryptocurrency into the mainstream.