East Africa Q1 2021 – VC Funding Report

As we have reported in previous analysis, 2020 saw Venture Capital investment into African technology companies decrease considerably as a result of the coronavirus (COVID-19) pandemic. But as we enter the second quarter of 2021, have companies found a return to business as usual? Our analysts take a look at the investment figures to find out more.

Technology investment in 2021 seems to have started the year positively. In Q1 2021, 114 venture capital raises (excluding non-equity assistance, alternative funding rounds or mergers, acquisitions) were announced across Africa, a slight decrease from the 119 investment rounds recorded in Q4 2020. While the number of reported deals is far lower than last year’s peak (137 reported in Q2 2020), investment value across Africa has increased from $217.9 million USD in Q4 2020 to $660.5 million in Q1 2021.

Figure 1: Total investment into technology companies across Africa since 2015

Source: Baobab Insights, (2021 year to date as of 31/03/2021)

Q1 2021 saw a number of large late stage funding announcements made which contributed significantly to the overall total. 10 funding rounds accounted for $553 million USD in investment over the quarter. This included Flutterwave’s $170 million USD, Series C raise in March 2021, South Africa’s TymeBank’s $109 million USD venture funding round in February and Gro Intelligence’s $85 million Series B announcement in January 2021.

East Africa sees increased investment

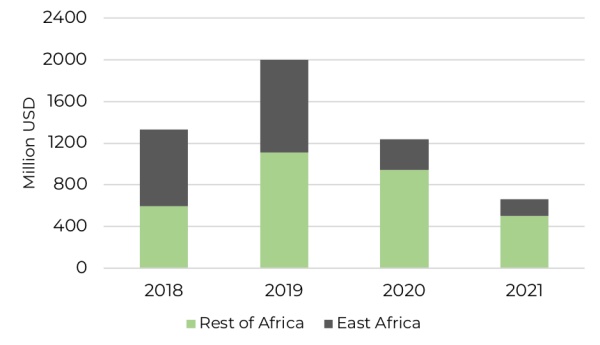

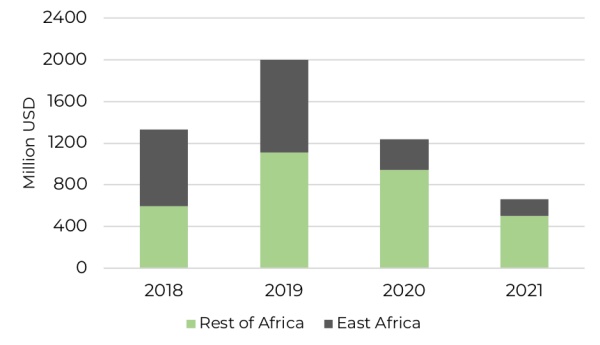

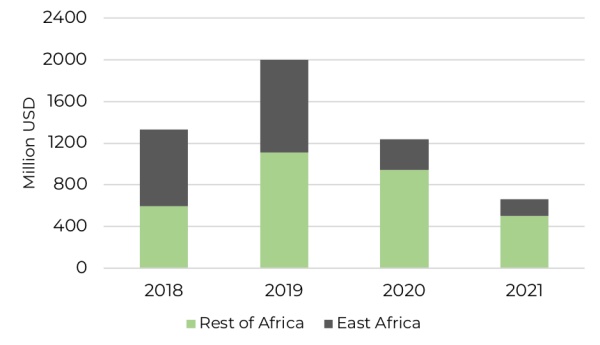

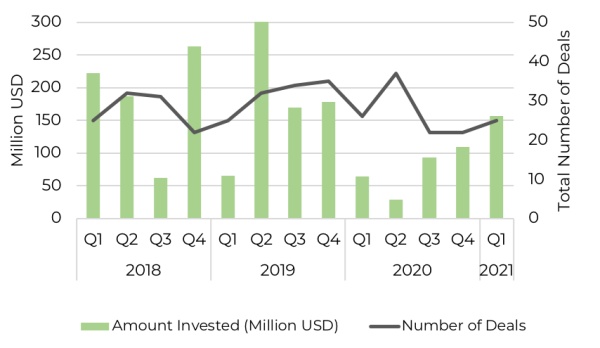

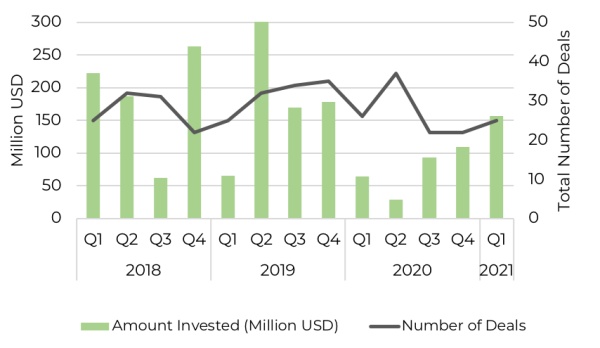

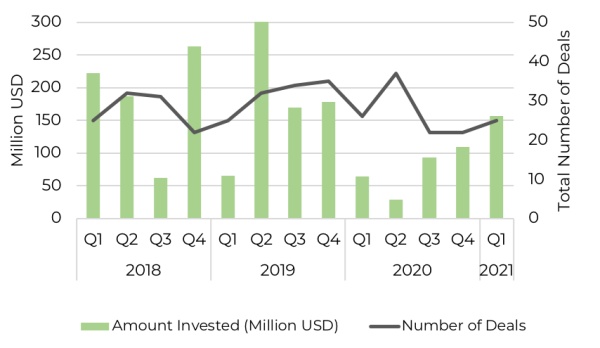

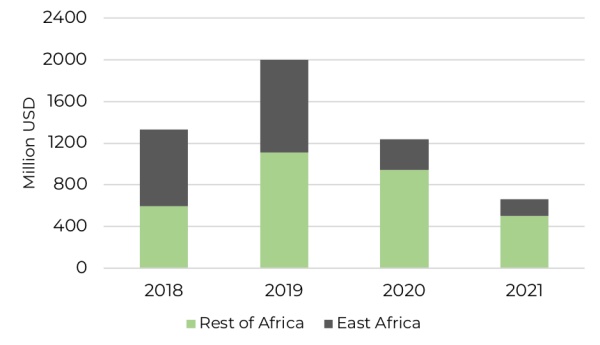

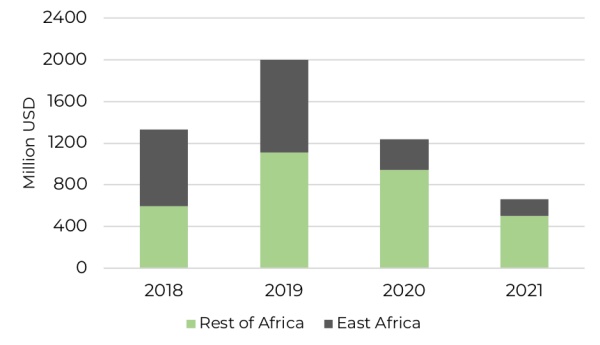

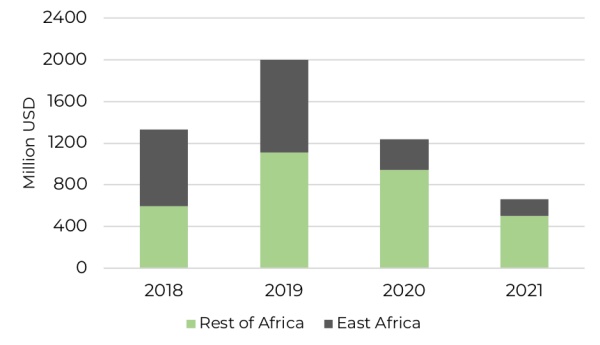

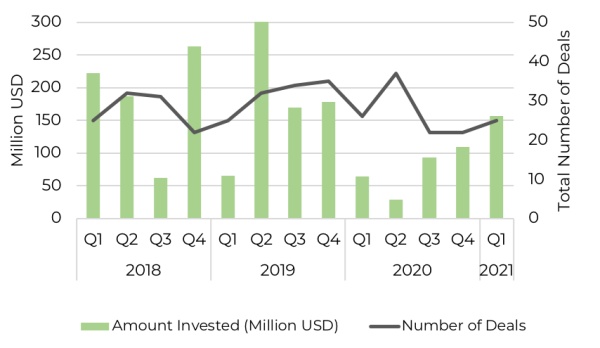

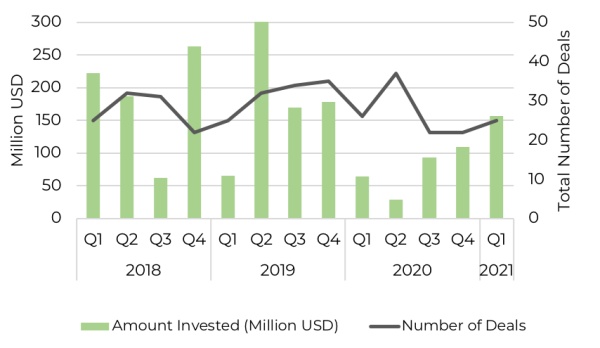

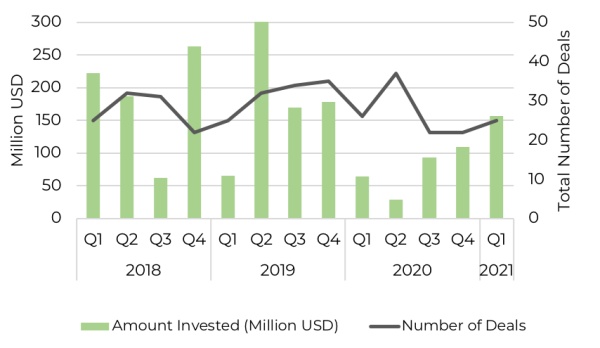

In the East Africa region, technology investment reduced from $885.9 million USD over 126 deals in 2019 to $256.9 million USD over $107 million USD in 2020 (figure 2). The impact of coronavirus is still ongoing, and recent measures have been put in place to curb new flare-ups across the East Africa region (such as the announcement of local lock-down in regions across Kenya). However, investment in the East Africa region has increased from $109.5 million USD across 22 deals in Q4 2020 to $156.6 million USD across 25 deals in Q1 2021 (figure 3). Companies in East Africa secured 24% of funding in 2021 (year to date), which is equivalent to the proportion of funding secured over the course of the previous year (figure 2).

Figure 2: Graph showing total amount invested into East African technology companies since 2018

Source: Baobab Insights, (2021 year to date as of 31/03/2021)

Figure 3: Quarterly investment into technology companies in East Africa since 2018

Source: Baobab Insights, (2021 year to date as of 31/03/2021)

Kenya remains a regional hub for investment

Figure 4: VCs actively looking to invest in Kenya in 2021

Are we missing anyone?

Submit Investor

While the East Africa region has a vibrant technology ecosystem, with deals being recorded across all countries in the region. Funding in Q1 2021 was heavily weighted towards companies headquartered in Kenya.

In 2020, $219.645 million USD was raised by companies headquartered in Kenya (74% of regional investment into technology companies), with a large proportion of this funding being secured by investors based in the region.

In Q1 2021, the proportion of investment secured by companies headquartered in Kenya fell slightly to $103.95 million USD, (66% of total regional investment).

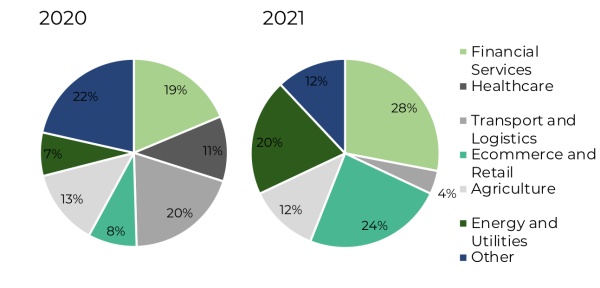

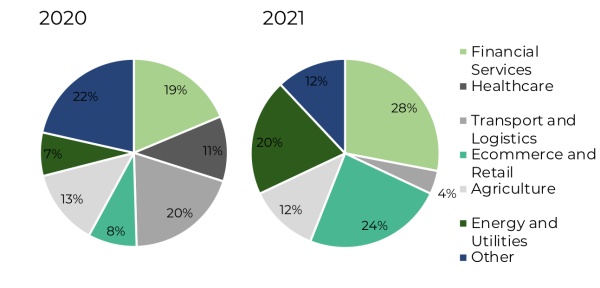

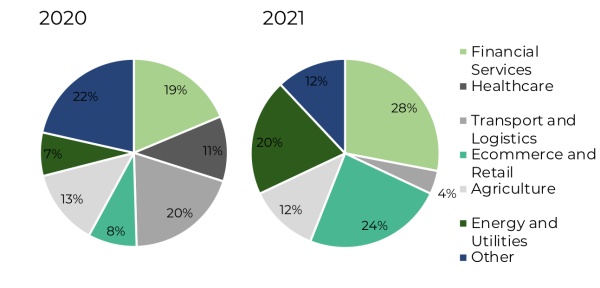

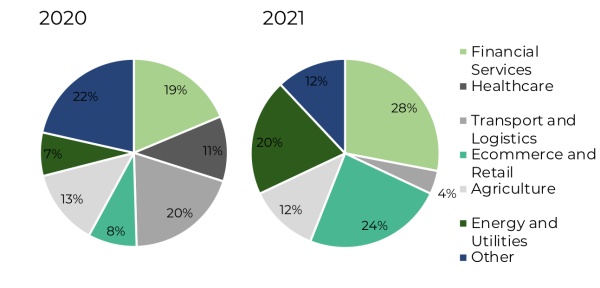

FinTech and E-commerce continue to attract investment

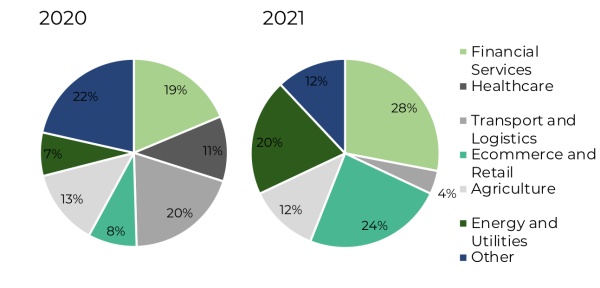

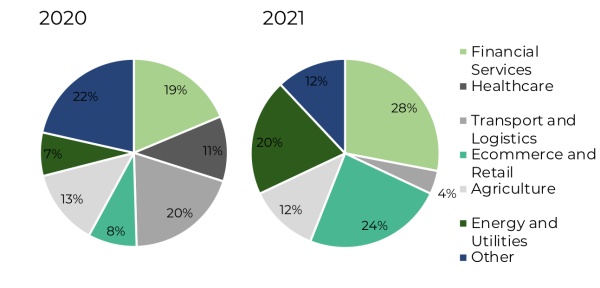

Across the East Africa region, FinTech companies and E-commerce and Online Retail saw the most investor activity in terms of number of deals over the first quarter of 2021. FinTech companies secured a total of 7 deals and e-Commerce companies accounting for 6 deals over the period. Additionally, companies in the Energy and Utilities sector, accounted for 5 investment rounds over the period (figure 5).

In terms of deal value, the AgTech sector accounted for $96 million USD raised over the quarter. The majority of this can be attributed to the $85 million USD Series B funding round raised by Gro Intelligence, an agriculture data and analytics company headquartered in Kenya and the USA.

Figure 5: Proportion of deals by sector across East Africa technology companies in 2020 and 2021

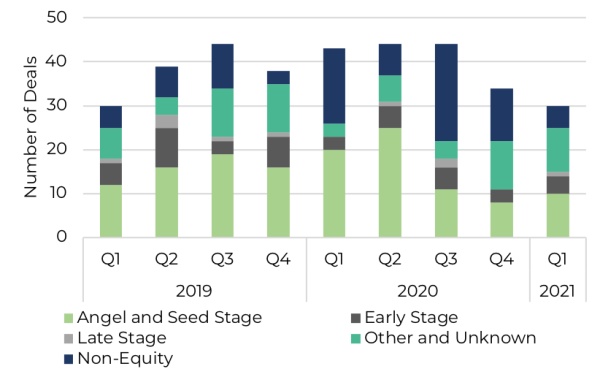

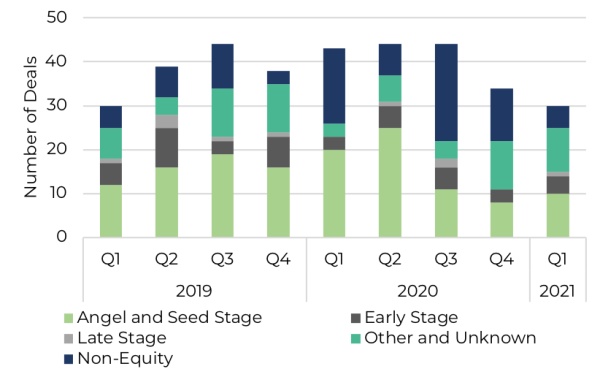

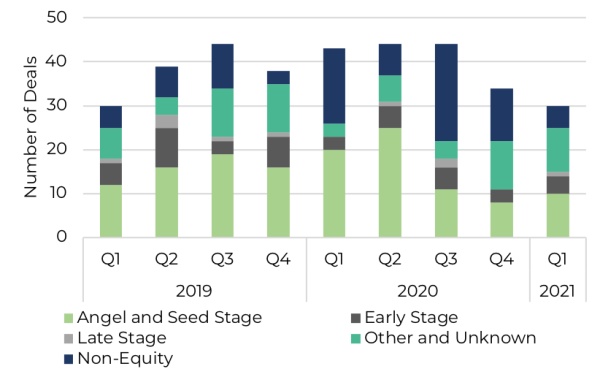

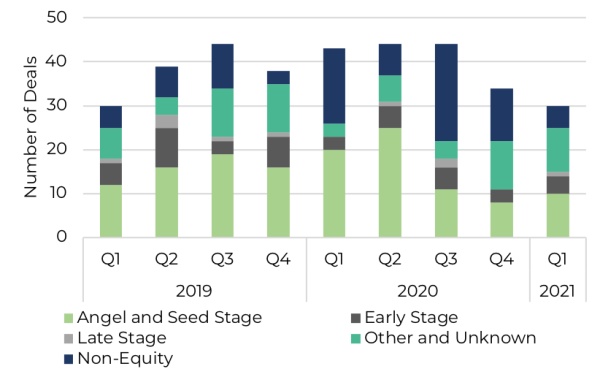

East Africa sees a slight dip in Early Stage Investment

Across all African regions, Pre-seed and Seed stage funding, i.e. funding rounds reported as pre-seed or seed stage deals with disclosed investment totalling $550,000 or less, saw a slight year on year increase between 2019 and 2020. In 2019, Pre-seed and Seed stage funding totalled $23.6 million USD, which increased to $24.91 million USD.

The proportion of Pre-Seed and Seed stage funding rounds also increased between 2019 and 2020 from 44.39% of all funding rounds to 46.37%.

In Q1 2021, the proportion of these Pre-Seed and Seed stage funding rounds decreased to 27.22%, totalling $3.605 million USD over the quarter (figure 6).

Figure 6: Quarterly number of funding rounds by stated investment stage since 2019 in East Africa

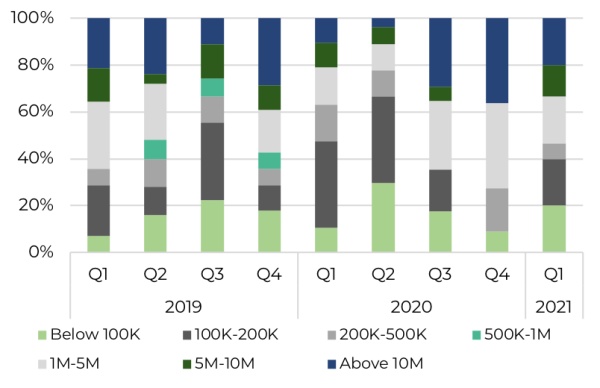

A promising start to the year

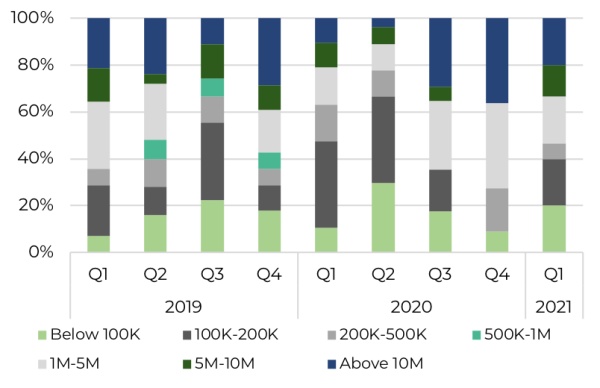

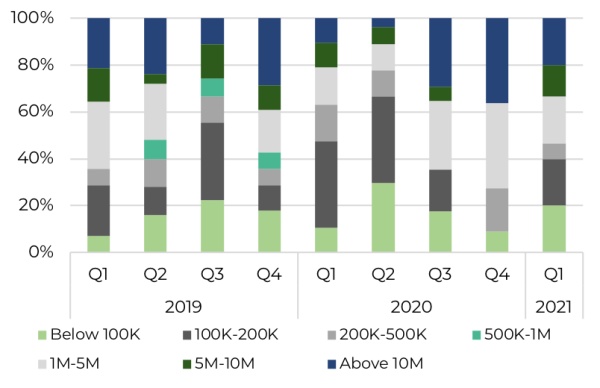

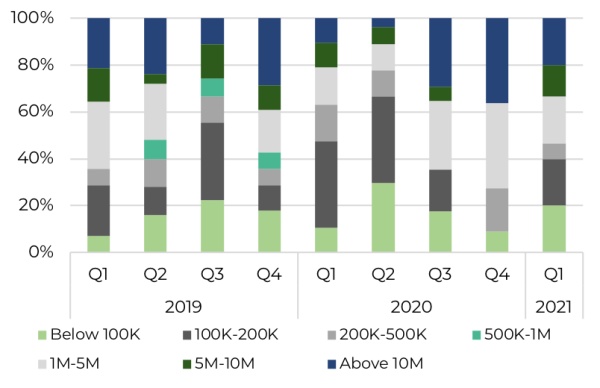

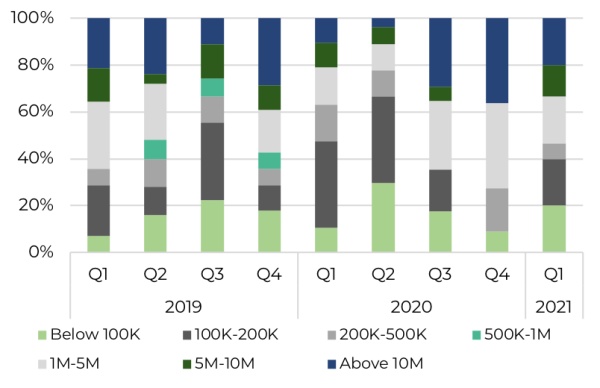

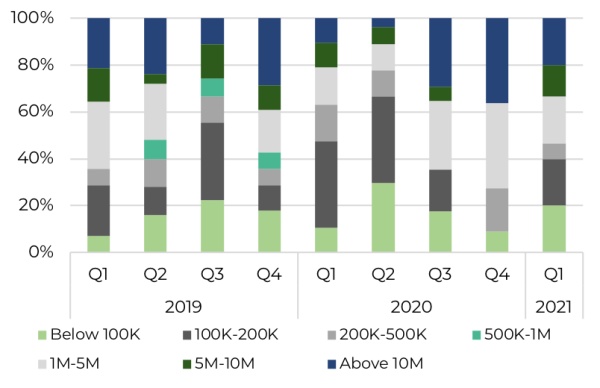

Figure 7: Proportion of funding rounds by total disclosed amount since 2019 in East Africa

After the difficulties faced throughout 2020, it is positive to see such a busy start to 2021. The East Africa region in particular seems to have seen a return to levels of activity seen in previous periods.

However, the impact of COVID-19 is far from over, what remains to be seen is how investors and founders deal with the uncertainty caused by the introduction of new restrictions.

East Africa Q1 2021 – VC Funding Report

As we have reported in previous analysis, 2020 saw Venture Capital investment into African technology companies decrease considerably as a result of the coronavirus (COVID-19) pandemic. But as we enter the second quarter of 2021, have companies found a return to business as usual? Our analysts take a look at the investment figures to find out more.

Technology investment in 2021 seems to have started the year positively. In Q1 2021, 114 venture capital raises (excluding non-equity assistance, alternative funding rounds or mergers, acquisitions) were announced across Africa, a slight decrease from the 119 investment rounds recorded in Q4 2020. While the number of reported deals is far lower than last year’s peak (137 reported in Q2 2020), investment value across Africa has increased from $217.9 million USD in Q4 2020 to $660.5 million in Q1 2021.

Figure 1: Total investment into technology companies across Africa since 2015

Source: Baobab Insights, (2021 year to date as of 31/03/2021)

Q1 2021 saw a number of large late stage funding announcements made which contributed significantly to the overall total. 10 funding rounds accounted for $553 million USD in investment over the quarter. This included Flutterwave’s $170 million USD, Series C raise in March 2021, South Africa’s TymeBank’s $109 million USD venture funding round in February and Gro Intelligence’s $85 million Series B announcement in January 2021.

East Africa sees increased investment

In the East Africa region, technology investment reduced from $885.9 million USD over 126 deals in 2019 to $256.9 million USD over $107 million USD in 2020 (figure 2). The impact of coronavirus is still ongoing, and recent measures have been put in place to curb new flare-ups across the East Africa region (such as the announcement of local lock-down in regions across Kenya). However, investment in the East Africa region has increased from $109.5 million USD across 22 deals in Q4 2020 to $156.6 million USD across 25 deals in Q1 2021 (figure 3). Companies in East Africa secured 24% of funding in 2021 (year to date), which is equivalent to the proportion of funding secured over the course of the previous year (figure 2).

Figure 2: Graph showing total amount invested into East African technology companies since 2018

Source: Baobab Insights, (2021 year to date as of 31/03/2021)

Figure 3: Quarterly investment into technology companies in East Africa since 2018

Source: Baobab Insights, (2021 year to date as of 31/03/2021)

Kenya remains a regional hub for investment

Figure 4: VCs actively looking to invest in Kenya in 2021

Are we missing anyone?

Submit Investor

While the East Africa region has a vibrant technology ecosystem, with deals being recorded across all countries in the region. Funding in Q1 2021 was heavily weighted towards companies headquartered in Kenya.

In 2020, $219.645 million USD was raised by companies headquartered in Kenya (74% of regional investment into technology companies), with a large proportion of this funding being secured by investors based in the region.

In Q1 2021, the proportion of investment secured by companies headquartered in Kenya fell slightly to $103.95 million USD, (66% of total regional investment).

FinTech and E-commerce continue to attract investment

Across the East Africa region, FinTech companies and E-commerce and Online Retail saw the most investor activity in terms of number of deals over the first quarter of 2021. FinTech companies secured a total of 7 deals and e-Commerce companies accounting for 6 deals over the period. Additionally, companies in the Energy and Utilities sector, accounted for 5 investment rounds over the period (figure 5).

In terms of deal value, the AgTech sector accounted for $96 million USD raised over the quarter. The majority of this can be attributed to the $85 million USD Series B funding round raised by Gro Intelligence, an agriculture data and analytics company headquartered in Kenya and the USA.

Figure 5: Proportion of deals by sector across East Africa technology companies in 2020 and 2021

East Africa sees a slight dip in Early Stage Investment

Across all African regions, Pre-seed and Seed stage funding, i.e. funding rounds reported as pre-seed or seed stage deals with disclosed investment totalling $550,000 or less, saw a slight year on year increase between 2019 and 2020. In 2019, Pre-seed and Seed stage funding totalled $23.6 million USD, which increased to $24.91 million USD.

The proportion of Pre-Seed and Seed stage funding rounds also increased between 2019 and 2020 from 44.39% of all funding rounds to 46.37%.

In Q1 2021, the proportion of these Pre-Seed and Seed stage funding rounds decreased to 27.22%, totalling $3.605 million USD over the quarter (figure 6).

Figure 6: Quarterly number of funding rounds by stated investment stage since 2019 in East Africa

A promising start to the year

Figure 7: Proportion of funding rounds by total disclosed amount since 2019 in East Africa

After the difficulties faced throughout 2020, it is positive to see such a busy start to 2021. The East Africa region in particular seems to have seen a return to levels of activity seen in previous periods.

However, the impact of COVID-19 is far from over, what remains to be seen is how investors and founders deal with the uncertainty caused by the introduction of new restrictions.