Baobab Briefing: East Africa 2020 Investment Update

It would seem that the only certainty in 2020 is that we must continue to expect the unexpected. As the world collectively entered lock-down and the impact of coronavirus (COVID-19) pandemic became clear, many analysts, Baobab Insights included, were cautious as to what this could mean for venture capital investment in Africa.

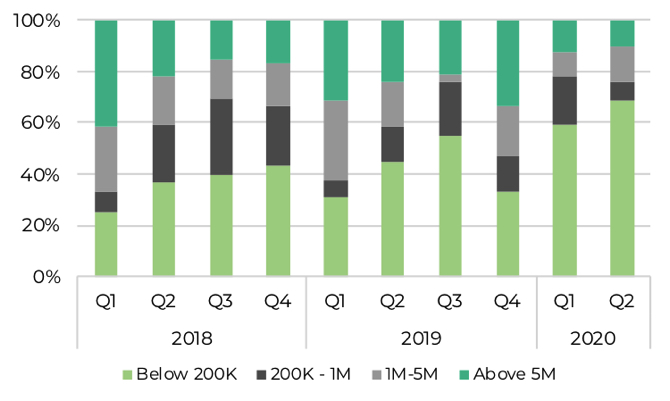

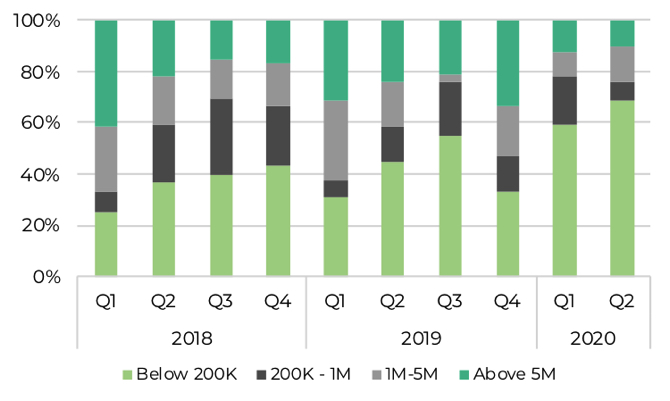

As we reach the mid-way point Q3 2020, it would appear that the predicted downturn in funding didn’t materialise as expected. For instance there has been a median average of 40 rounds per quarter secured by technology companies in East Africa in 2020, a slight jump on the 35.5 rounds per quarter closed in 2019. However, it is also clear that adjusting to lock-down has brought about changes both in investor focus and investment stage in the region. The proportion of rounds totalling $200,000 USD and below in East Africa made up 64% of the total number of deals in 2020, quite a jump from 42% in 2019. So what does this mean for founders, and is this the new business as usual?

In this report we re-visit our East Africa regional funding data, and explore some of the key investment trends and raises over Q2 2020.

Proportion of funding rounds closed per quarter in East Africa by investment range over from 2018 to 2020:

This report was first published in August 2020.

Download full report in PDF

Download Report

Download full report in PDF

Download Report

Contact the authors for more information about our Insight

Baobab Briefing: East Africa 2020 Investment Update

It would seem that the only certainty in 2020 is that we must continue to expect the unexpected. As the world collectively entered lock-down and the impact of coronavirus (COVID-19) pandemic became clear, many analysts, Baobab Insights included, were cautious as to what this could mean for venture capital investment in Africa.

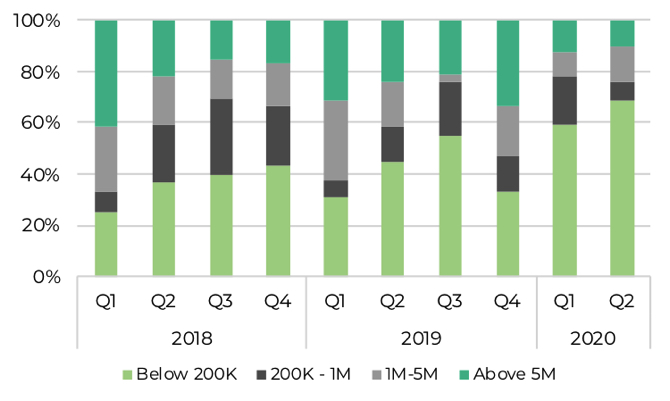

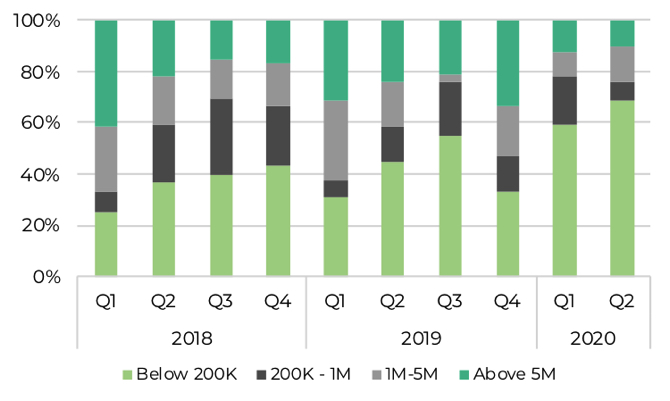

As we reach the mid-way point Q3 2020, it would appear that the predicted downturn in funding didn’t materialise as expected. For instance there has been a median average of 40 rounds per quarter secured by technology companies in East Africa in 2020, a slight jump on the 35.5 rounds per quarter closed in 2019. However, it is also clear that adjusting to lock-down has brought about changes both in investor focus and investment stage in the region. The proportion of rounds totalling $200,000 USD and below in East Africa made up 64% of the total number of deals in 2020, quite a jump from 42% in 2019. So what does this mean for founders, and is this the new business as usual?

In this report we re-visit our East Africa regional funding data, and explore some of the key investment trends and raises over Q2 2020.

Proportion of funding rounds closed per quarter in East Africa by investment range over from 2018 to 2020:

This report was first published in August 2020.