Baobab Briefing: 2020 Merchant and Payment Services Report

Investment into the Africa FinTech sector has increased from $59.658 million USD in 2016 to $938.852 million USD in 2019. While investment into merchant and payment services has increased in real terms; from $19.525 million USD in 2016 to $234.262 million in 2019, the proportion of total funding secured by the merchant services and payments sector has decreased year on year from 38% in 2016 to 25% in 2019.

This is perhaps indicative of a number of factors; first, payment services are an enabling technology from which other financial services can be built, therefore it is only natural that the proportion of other solutions securing investment is likely to increase.

However, larger incumbent FinTech companies are beginning to flex their muscles. Flutterwave, announced a strategic partnership with Amazon Web Services in March 2020, and MFS Africa, a South African payments provider, has acquired Apposit and Beyonic helping to roll-out its services across the East Africa region.

In this report, we dive into the key investment trends and market developments in the merchant services space since 2015, and take a closer look at some of the significant developments over the past year.

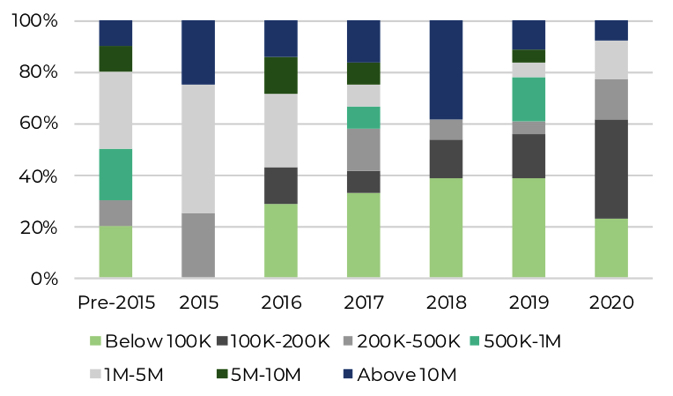

Proportion of funding rounds closed by investment range into African merchant services companies since 2015:

This report was first published in September 2020.

Download full report in PDF

Download Report

Download full report in PDF

Download Report

Contact the authors for more information about our Insight

Baobab Briefing: 2020 Merchant and Payment Services Report

Investment into the Africa FinTech sector has increased from $59.658 million USD in 2016 to $938.852 million USD in 2019. While investment into merchant and payment services has increased in real terms; from $19.525 million USD in 2016 to $234.262 million in 2019, the proportion of total funding secured by the merchant services and payments sector has decreased year on year from 38% in 2016 to 25% in 2019.

This is perhaps indicative of a number of factors; first, payment services are an enabling technology from which other financial services can be built, therefore it is only natural that the proportion of other solutions securing investment is likely to increase.

However, larger incumbent FinTech companies are beginning to flex their muscles. Flutterwave, announced a strategic partnership with Amazon Web Services in March 2020, and MFS Africa, a South African payments provider, has acquired Apposit and Beyonic helping to roll-out its services across the East Africa region.

In this report, we dive into the key investment trends and market developments in the merchant services space since 2015, and take a closer look at some of the significant developments over the past year.

Proportion of funding rounds closed by investment range into African merchant services companies since 2015:

This report was first published in September 2020.