Southern Africa VC Funding Market Map – H1 2021

This week Yoco, a payments platform based in South Africa, announced they have closed a $83 million USD Series C funding round. The company focusses on providing cashless payment options to small and medium sized enterprises (SMEs), and reportedly has around 150,000 such clients regularly using their services, a five-fold increase from the 30,000 users the company reported at the time of their Series B raise back in 2018.

Backed by the likes of Dragoneer Investment Group, Breyer Capital, HOF Capital, The Raba Partnership, 4DX Ventures, TO Ventures, and Futuregrowth Asset Management, the team at Yoco intend on using this latest investment round to help support their continued growth. What is impressive is that this investment has come at a time when their core customers, South Africa’s SME businesses, have been rocked by the continual lockdowns, curfews and restrictions imposed to help fight the Covid-19 pandemic.

A tough year for SMEs

According to a McKinsey report published in Q2 2021 SMEs across South Africa represent over 90% of businesses, and employ between 50% and 60% of the country’s workforce across all sectors. They are also responsible for a quarter of job growth in the private sector. Yoco’s own business sentiment analysis, Yoco Business Pulse, highlights the difficult reality for many SME businesses over the last 18 months; during lockdown 80% of SME businesses in the retail sector had to close, and 83% reported their business had been severely affected over the last year.

What is interesting is how both consumers and businesses have adapted over the last 18 months. 35% of Yoco’s respondents indicated that they are going to increase their online presence over the next year, and 20% of respondents plan to move their retail company online.

In an interview with TechCrunch, a news service, Yoco’s co-founder Carl Wazen discussed recent business trends that followed months of lockdown “Recent consumer behaviour shows a shift away from cash, and businesses have to rapidly adapt to this change. This presents a huge opportunity, and it is our mission to support that transition”.

As we have seen in previous reports changing consumer trends, such as the transition away from cash, and a greater desire for online retail experiences, is being mirrored in the investment trends within the broader e-commerce and financial services sectors.

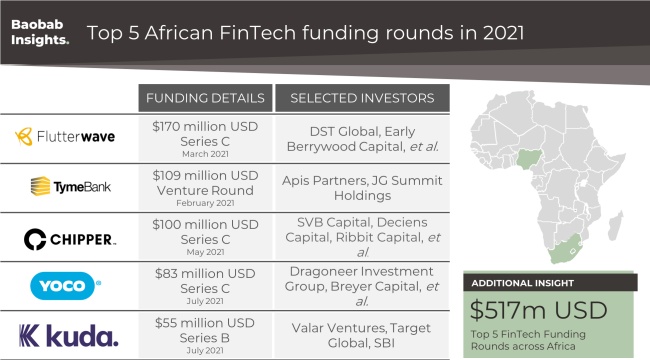

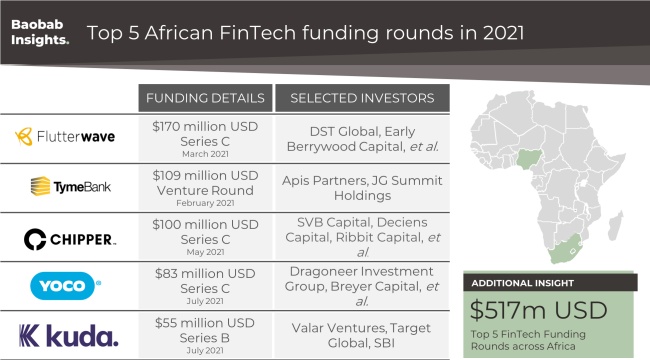

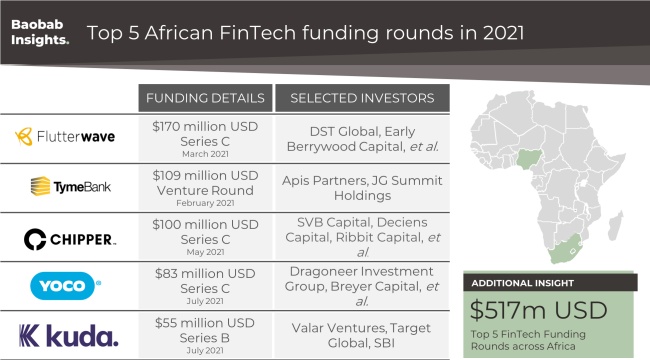

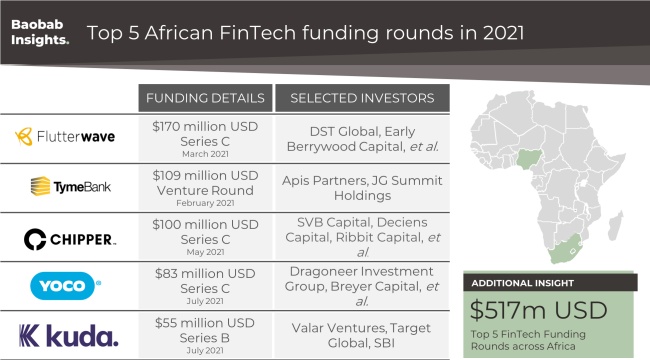

In fact, 3 of the 5 largest funding rounds in 2021 (year to date) have all been closed by FinTech companies, with 5 largest FinTech funding rounds amounted to more than $500 million USD, with two companies based in the Southern Africa region. But, what does Yoco’s raise mean for the rest of the Southern Africa region?

2021 off to a huge start

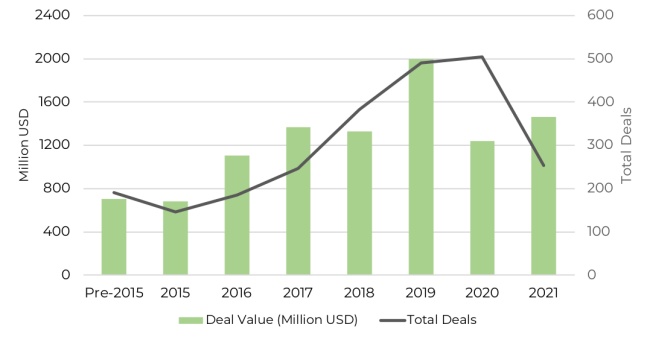

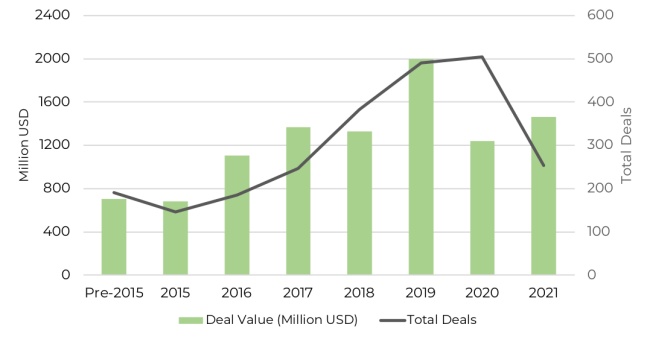

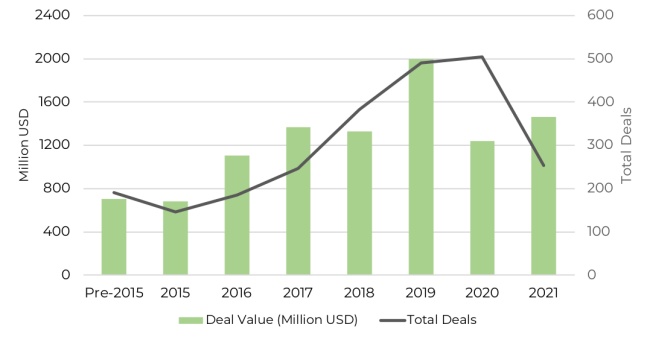

As we pass the mid-point of 2021, the total funding raised by start-ups across Africa has already surpassed the total raised in 2020. 2020 recorded a total of $1.23 billion USD in funding across 504 rounds, in 2021 this has jumped up to $1.46 billion USD across 253 funding rounds.

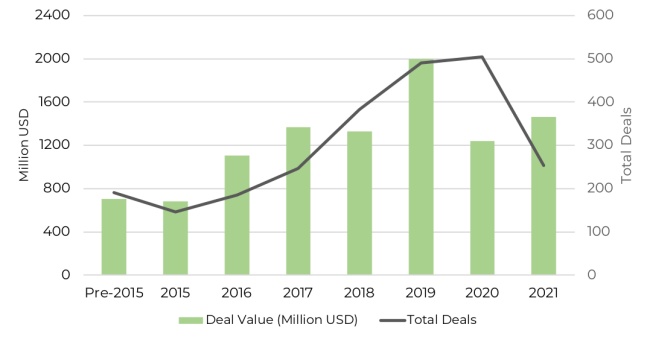

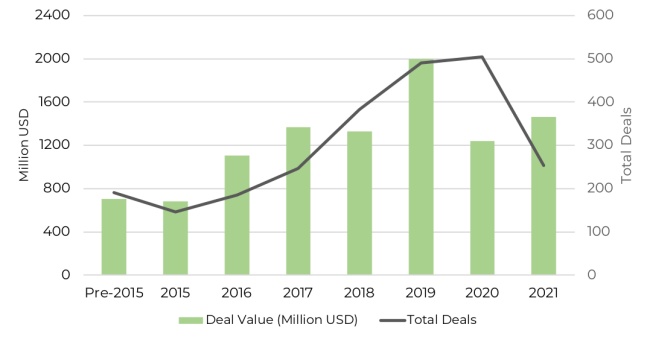

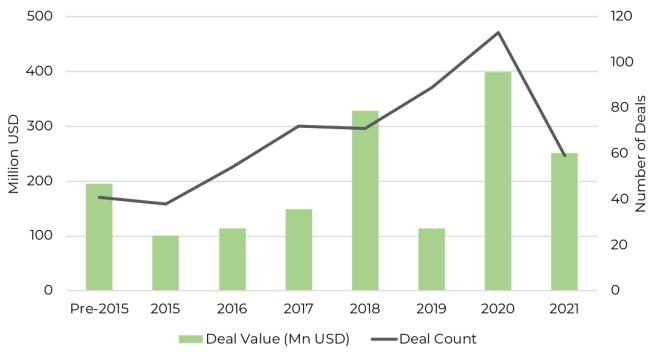

Figure 1: Total investment in Africa’s technology companies since 2015 (2021 year to date)

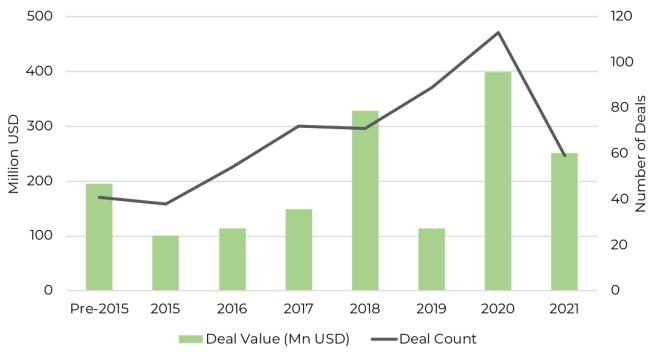

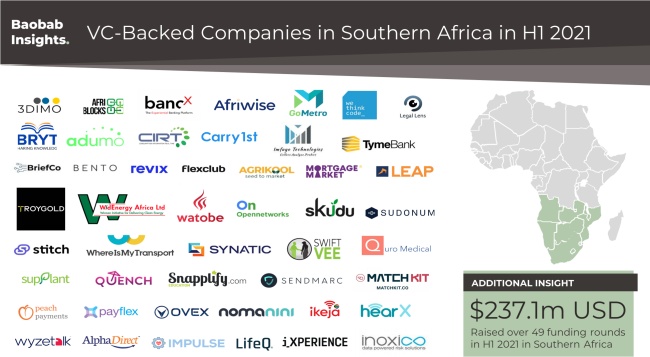

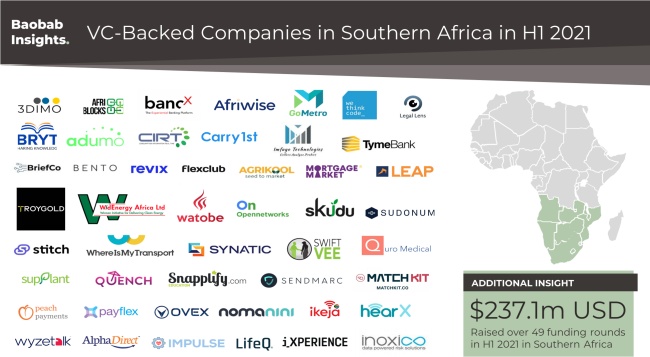

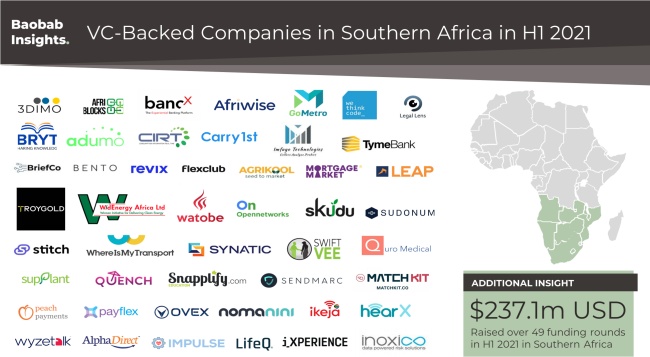

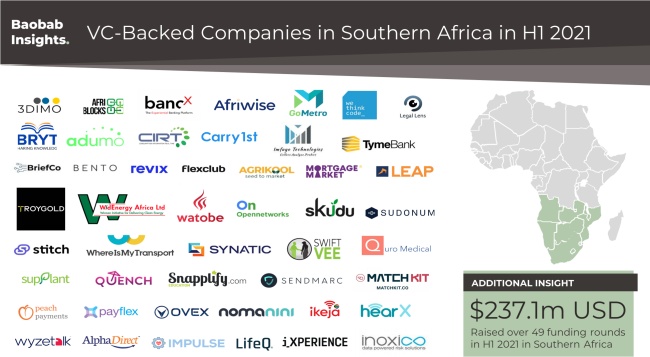

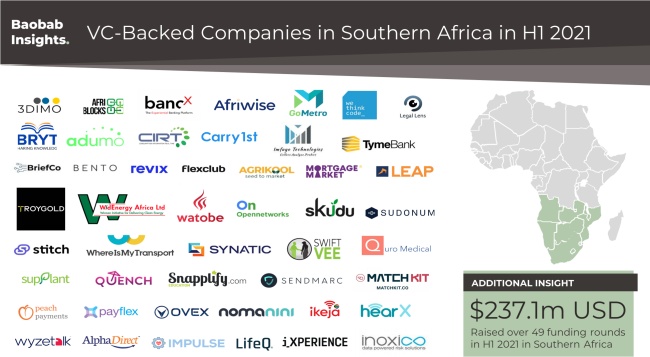

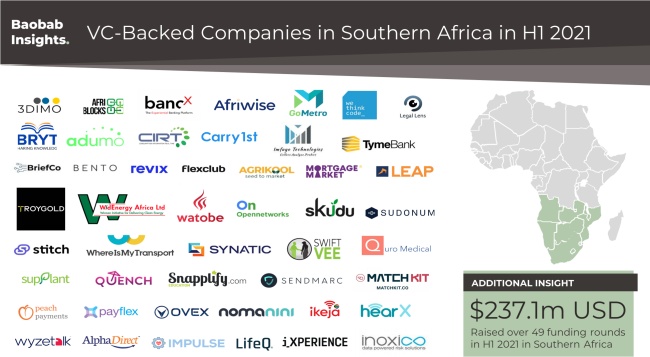

In Southern Africa, this trend is slightly less pronounced. In total, Southern Africa’s technology companies raised over $398 million USD across 113 venture funding rounds in 2020. This figure has exceeded $238.1 million USD across 49 funding rounds in H1 2021, and over $250.8 million USD across 59 funding rounds including those raised until 21st July 2021.

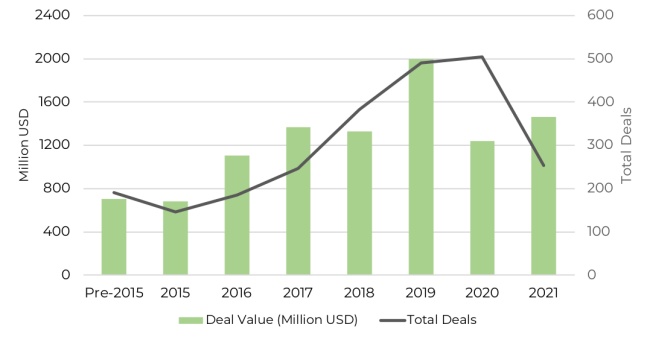

Figure 2: Total investment across Southern Africa’s technology companies since 2015 (2021 year to date)

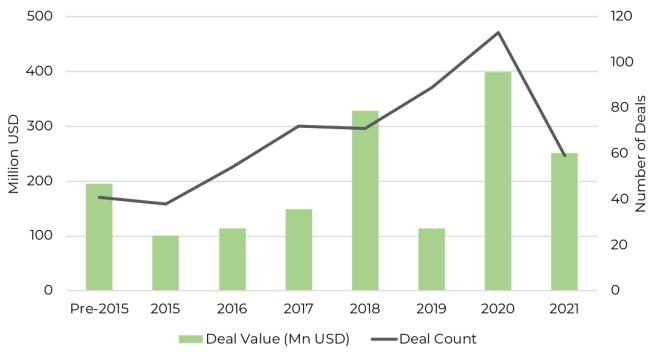

Investment over the past quarter has dipped slightly following a very positive start to the year. Q1 2021 saw Southern Africa’s technology start-ups raise a total of $147 million USD across 27 funding rounds, falling to $90.4 million USD across 22 funding rounds in Q2 2021.

Figure 3: Quarterly investment into Southern African technology companies since 2018

Mixed news for early-stage investment?

Over all the funding trend shows a year on year increase in both the median raise per quarter and median number of deals per quarter across the Southern Africa region. 2018 saw a median of 17 raises per quarter, and a median of $78.2 million USD raised across all companies per quarter. This has increased to 24.5 deals per quarter, and $118 million USD invested per quarter in 2021 across all Southern African companies.

Table 1: Average VC Funding per Quarter closed by Southern African technology companies since 2018

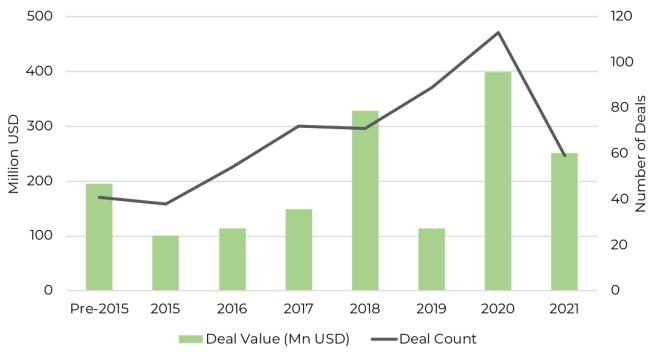

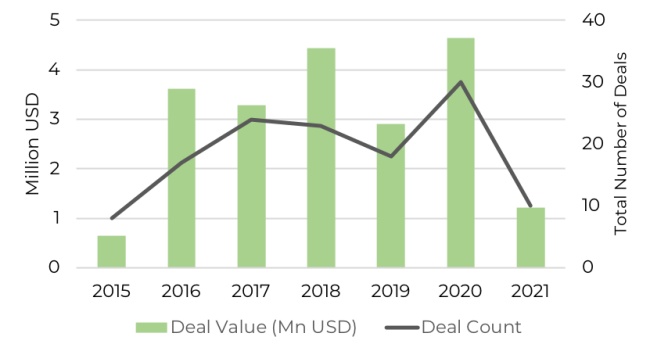

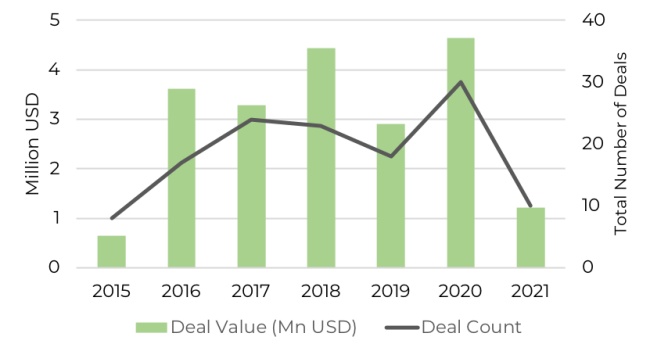

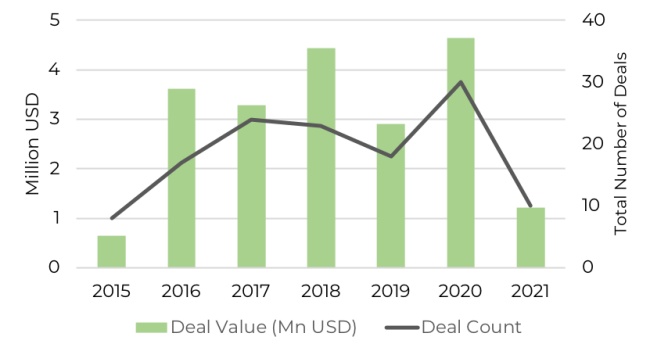

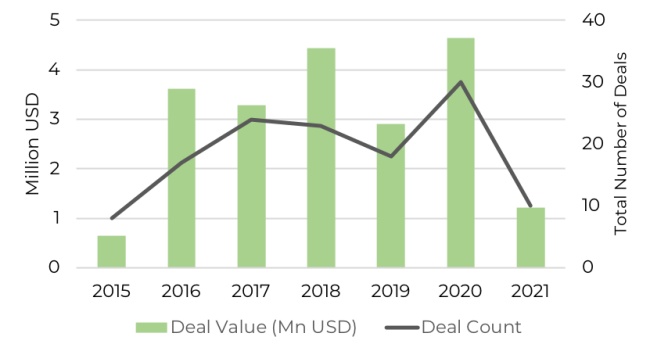

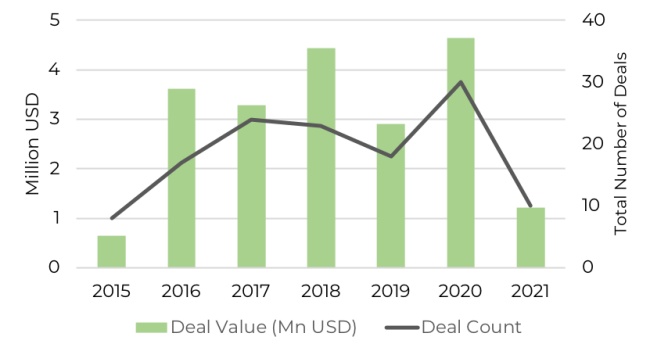

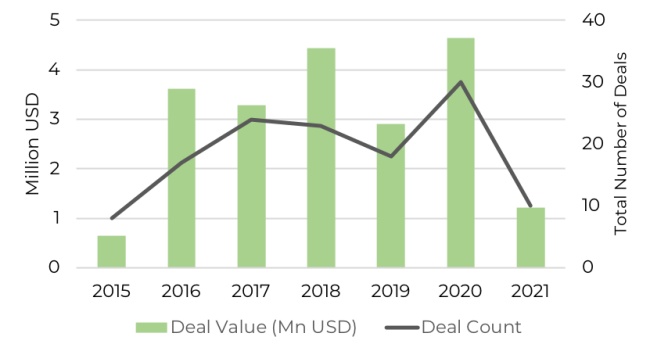

In contrast to this, the rate of early stage start-up investment (i.e. any round at the pre-seed or seed stage totalling $550,000 or less) appears to have slowed in comparison to 2020. In 2019, early stage funding totalled $2.9 million USD across 18 deals, this increased to $4.6 million USD across 30 deals in 2020. Up until 30th June 2020, there has been a total of $1.2 million USD raised across 10 deals. As a proportion of all deals, this represents a fall from 27% of all deals in 2020 to 17% of all deals in 2021.

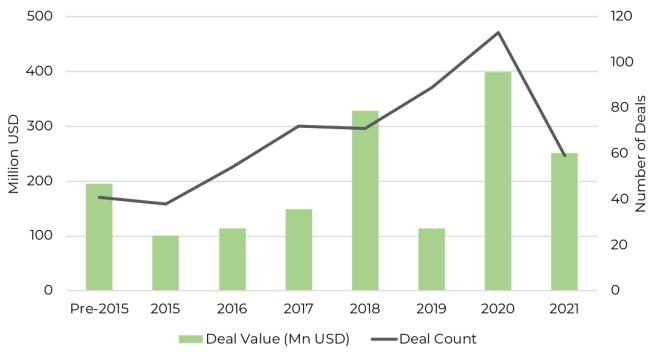

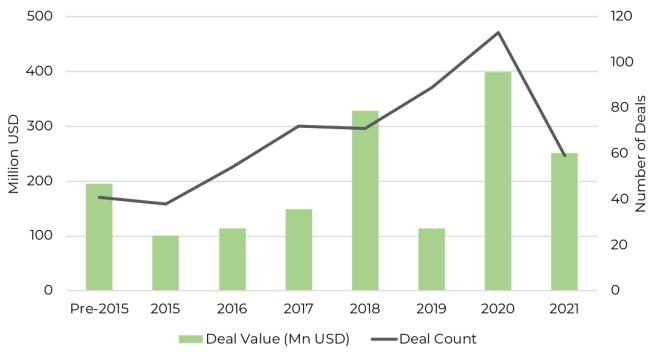

Figure 4: Early-stage funding into Southern African technology start-ups since 2015

FinTech Focussed Funding?

Are we missing anyone?

Submit Start-up

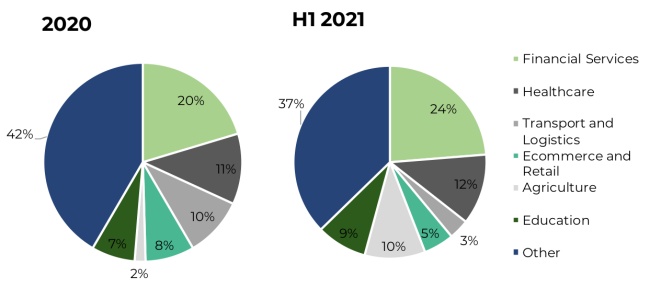

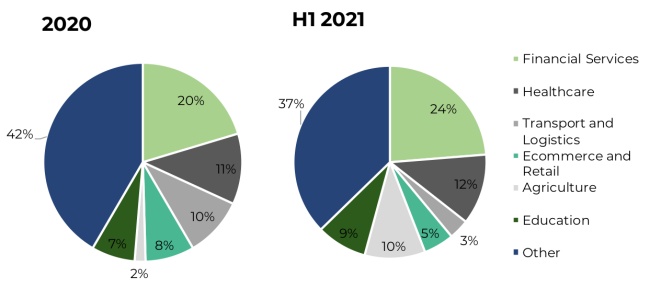

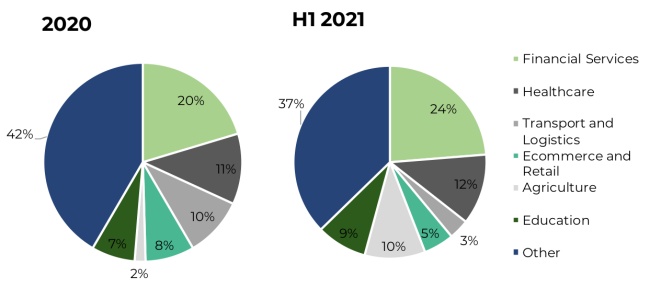

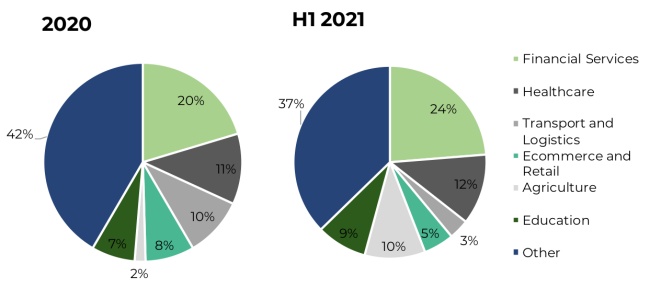

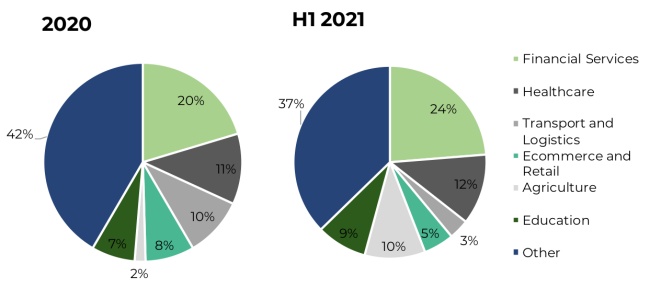

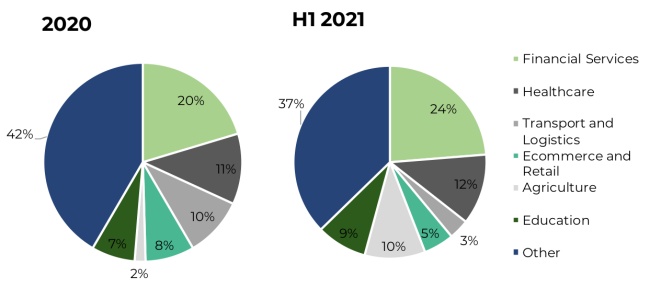

The proportion of FinTech funding rounds increased between 2020 and 2021 from 20% to 24% of total funding rounds across all sectors. However, the biggest proportional increase in funding rounds was seen in the Agriculture sector. Increasing from 2% in 2020 to 10% of total funding rounds in 2021. The transport and logistics sector recorded the largest fall in the number of deals per sector. Dropping from 10% of total deals in 2020 to 3% of total deals in H1 2021.

Figure 5: Proportion of funding rounds secured by Southern African technology companies in 2020 and H1 2021 by sector

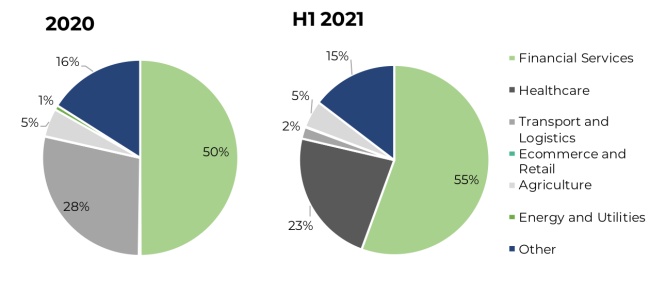

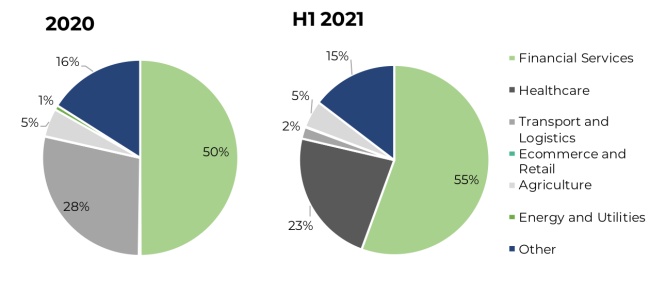

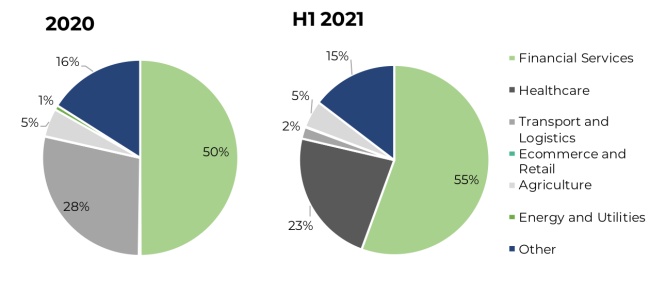

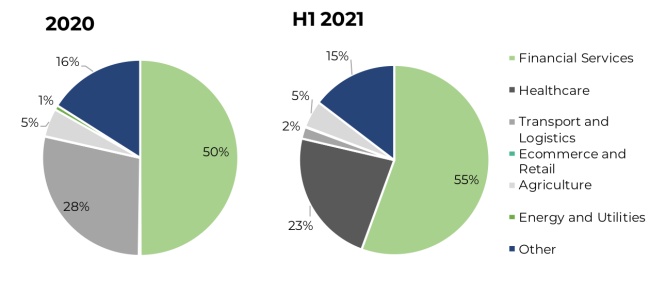

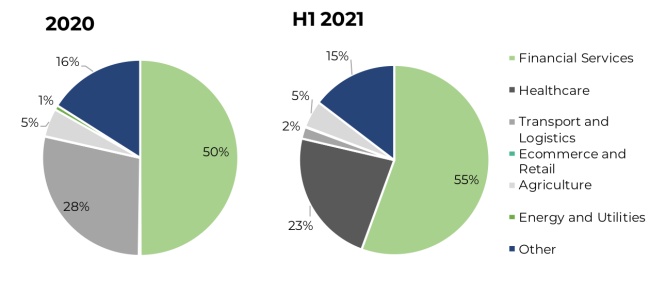

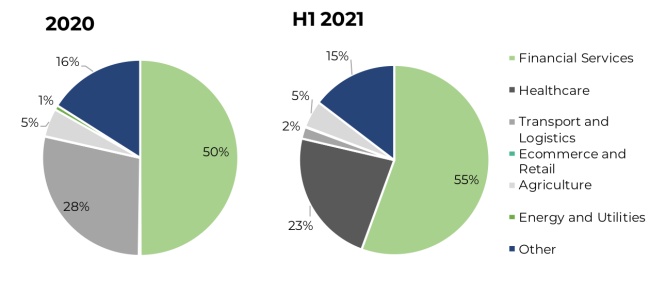

Perhaps unsurprisingly, FinTech companies secured the lion’s share of VC funding, particularly given the number of large later stage funding deals announced in the past 6 months. Over all, FinTech funding increased from 50% of total funding in 2020, to 55% of total funding in 2021.

Figure 6: Proportion of total funding secured by Southern African technology companies in 2020 and H1 2021 by sector

What is the state of play for Southern African technology start-ups?

Southern Africa has navigated a tricky year. The impact of the Covid-19 pandemic, social unrest and other economic factors will no doubt create local and regional challenges. However, what is also clear, highlighted by Yoco’s recent raise, is that while these challenges are already being felt by their SME business customers, the signs of recovery and adaptation are also there.

These larger late-stage funding rounds should very much be applauded. They are indicators of hard work, and a company finding true product-market fit, even under difficult business conditions. However, while the drop off in early-stage funding may not be a long-term trend, it may mean that these funding rounds become less frequent in the future?

Southern Africa VC Funding Market Map – H1 2021

This week Yoco, a payments platform based in South Africa, announced they have closed a $83 million USD Series C funding round. The company focusses on providing cashless payment options to small and medium sized enterprises (SMEs), and reportedly has around 150,000 such clients regularly using their services, a five-fold increase from the 30,000 users the company reported at the time of their Series B raise back in 2018.

Backed by the likes of Dragoneer Investment Group, Breyer Capital, HOF Capital, The Raba Partnership, 4DX Ventures, TO Ventures, and Futuregrowth Asset Management, the team at Yoco intend on using this latest investment round to help support their continued growth. What is impressive is that this investment has come at a time when their core customers, South Africa’s SME businesses, have been rocked by the continual lockdowns, curfews and restrictions imposed to help fight the Covid-19 pandemic.

A tough year for SMEs

According to a McKinsey report published in Q2 2021 SMEs across South Africa represent over 90% of businesses, and employ between 50% and 60% of the country’s workforce across all sectors. They are also responsible for a quarter of job growth in the private sector. Yoco’s own business sentiment analysis, Yoco Business Pulse, highlights the difficult reality for many SME businesses over the last 18 months; during lockdown 80% of SME businesses in the retail sector had to close, and 83% reported their business had been severely affected over the last year.

What is interesting is how both consumers and businesses have adapted over the last 18 months. 35% of Yoco’s respondents indicated that they are going to increase their online presence over the next year, and 20% of respondents plan to move their retail company online.

In an interview with TechCrunch, a news service, Yoco’s co-founder Carl Wazen discussed recent business trends that followed months of lockdown “Recent consumer behaviour shows a shift away from cash, and businesses have to rapidly adapt to this change. This presents a huge opportunity, and it is our mission to support that transition”.

As we have seen in previous reports changing consumer trends, such as the transition away from cash, and a greater desire for online retail experiences, is being mirrored in the investment trends within the broader e-commerce and financial services sectors.

In fact, 3 of the 5 largest funding rounds in 2021 (year to date) have all been closed by FinTech companies, with 5 largest FinTech funding rounds amounted to more than $500 million USD, with two companies based in the Southern Africa region. But, what does Yoco’s raise mean for the rest of the Southern Africa region?

2021 off to a huge start

As we pass the mid-point of 2021, the total funding raised by start-ups across Africa has already surpassed the total raised in 2020. 2020 recorded a total of $1.23 billion USD in funding across 504 rounds, in 2021 this has jumped up to $1.46 billion USD across 253 funding rounds.

Figure 1: Total investment in Africa’s technology companies since 2015 (2021 year to date)

In Southern Africa, this trend is slightly less pronounced. In total, Southern Africa’s technology companies raised over $398 million USD across 113 venture funding rounds in 2020. This figure has exceeded $238.1 million USD across 49 funding rounds in H1 2021, and over $250.8 million USD across 59 funding rounds including those raised until 21st July 2021.

Figure 2: Total investment across Southern Africa’s technology companies since 2015 (2021 year to date)

Investment over the past quarter has dipped slightly following a very positive start to the year. Q1 2021 saw Southern Africa’s technology start-ups raise a total of $147 million USD across 27 funding rounds, falling to $90.4 million USD across 22 funding rounds in Q2 2021.

Figure 3: Quarterly investment into Southern African technology companies since 2018

Mixed news for early-stage investment?

Over all the funding trend shows a year on year increase in both the median raise per quarter and median number of deals per quarter across the Southern Africa region. 2018 saw a median of 17 raises per quarter, and a median of $78.2 million USD raised across all companies per quarter. This has increased to 24.5 deals per quarter, and $118 million USD invested per quarter in 2021 across all Southern African companies.

Table 1: Average VC Funding per Quarter closed by Southern African technology companies since 2018

In contrast to this, the rate of early stage start-up investment (i.e. any round at the pre-seed or seed stage totalling $550,000 or less) appears to have slowed in comparison to 2020. In 2019, early stage funding totalled $2.9 million USD across 18 deals, this increased to $4.6 million USD across 30 deals in 2020. Up until 30th June 2020, there has been a total of $1.2 million USD raised across 10 deals. As a proportion of all deals, this represents a fall from 27% of all deals in 2020 to 17% of all deals in 2021.

Figure 4: Early-stage funding into Southern African technology start-ups since 2015

FinTech Focussed Funding?

Are we missing anyone?

Submit Start-up

The proportion of FinTech funding rounds increased between 2020 and 2021 from 20% to 24% of total funding rounds across all sectors. However, the biggest proportional increase in funding rounds was seen in the Agriculture sector. Increasing from 2% in 2020 to 10% of total funding rounds in 2021. The transport and logistics sector recorded the largest fall in the number of deals per sector. Dropping from 10% of total deals in 2020 to 3% of total deals in H1 2021.

Figure 5: Proportion of funding rounds secured by Southern African technology companies in 2020 and H1 2021 by sector

Perhaps unsurprisingly, FinTech companies secured the lion’s share of VC funding, particularly given the number of large later stage funding deals announced in the past 6 months. Over all, FinTech funding increased from 50% of total funding in 2020, to 55% of total funding in 2021.

Figure 6: Proportion of total funding secured by Southern African technology companies in 2020 and H1 2021 by sector

What is the state of play for Southern African technology start-ups?

Southern Africa has navigated a tricky year. The impact of the Covid-19 pandemic, social unrest and other economic factors will no doubt create local and regional challenges. However, what is also clear, highlighted by Yoco’s recent raise, is that while these challenges are already being felt by their SME business customers, the signs of recovery and adaptation are also there.

These larger late-stage funding rounds should very much be applauded. They are indicators of hard work, and a company finding true product-market fit, even under difficult business conditions. However, while the drop off in early-stage funding may not be a long-term trend, it may mean that these funding rounds become less frequent in the future?