New Technology Developments: Product Launches and Regional Expansion in February 2021

Venture Capital investment activity in Africa continued a strong start to 2021 this February. In total, $172.66 million was invested into companies across 44 deals (excluding prizes, grants and non-equity assistance), an increase from January 2021 which saw $144.304 million invested across 24 deals.

Notable funding rounds during the month included TymeBank, a South African digital bank providing services through a mobile app and network of smart ATMs, who secured $109 million from Apis Partners and JG Summit Holdings, along with South-African based hearX Group, a HealthTech company that has created smart-phone powered hearing tests, and raised an $8.3 million Series A round.

Despite high levels of investment activity in South Africa during the month, February also included the unexpected announcement that the Section 12 J tax incentive in South Africa was set to end in June 2021.

With such a dynamic month, we took a look at the new product launches and market expansions occurring across Africa.

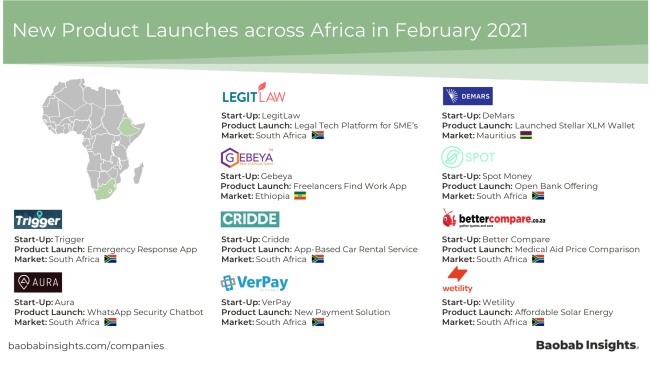

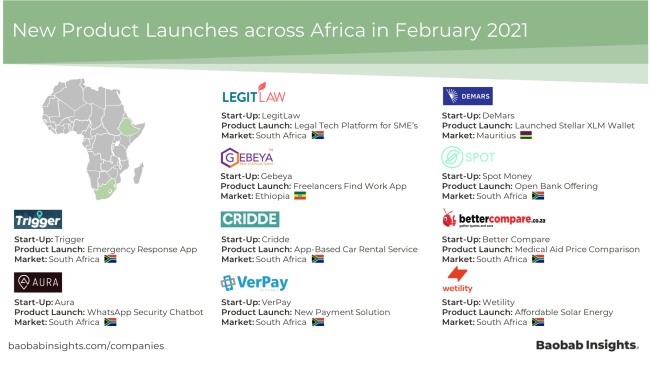

New Product Launches in February 2021

Are we missing anyone?

Submit Company Announcment

Our 2020 Technology Start-up Funding Report highlighted that the FinTech sector continued its dominance in terms of the number of investment deals and the total sum of investment received last year. February mirrored this high level of activity and innovation in the sector. FinTech companies accounted for 30% of the new product launches mapped. These launches included Spot Money, who have created the South Africa’s first open banking offering that aims to function as a one-stop-single customer-centric platform catering to a variety of user’s needs.

Interestingly, February saw two South-African based companies, Trigger and Aura, both launch products focused on connecting individuals in need with emergency services and security providers. Auru, a WhatsApp enabled security chatbot, connects users with AURA’s nationwide network of over 1,500 armed responders. While Trigger’s innovative app provides real-time access to a network of 220 independent services including; armed response, paramedic, roadside assistance, legal advice, and trauma counselling.

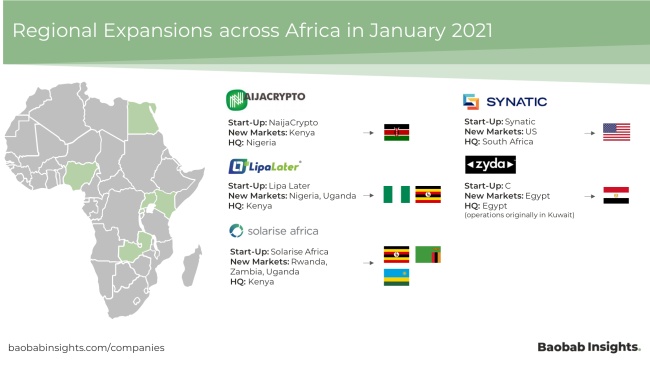

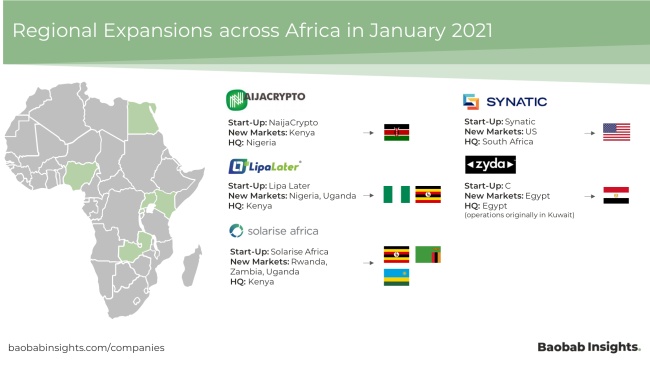

February 2021 Market Expansion and Regional Growth

Are we missing anyone?

Submit Company Announcment

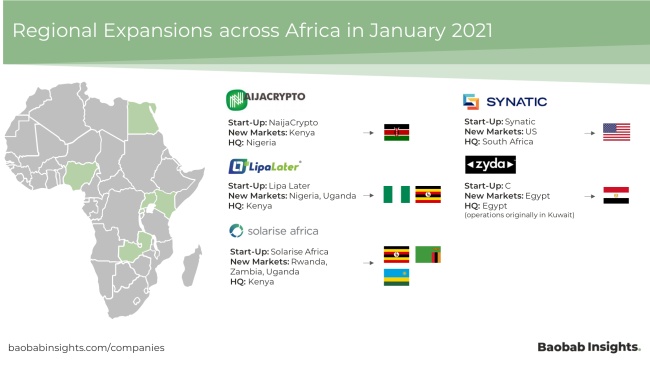

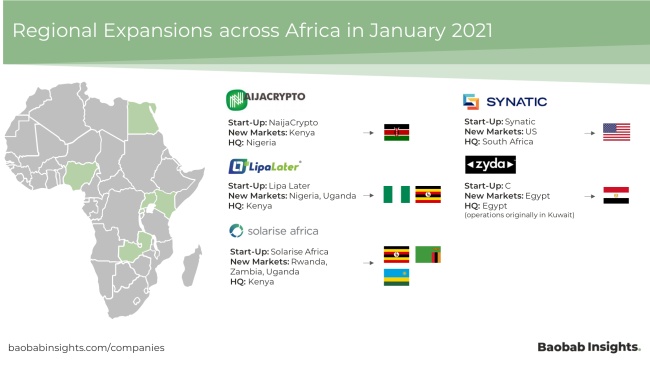

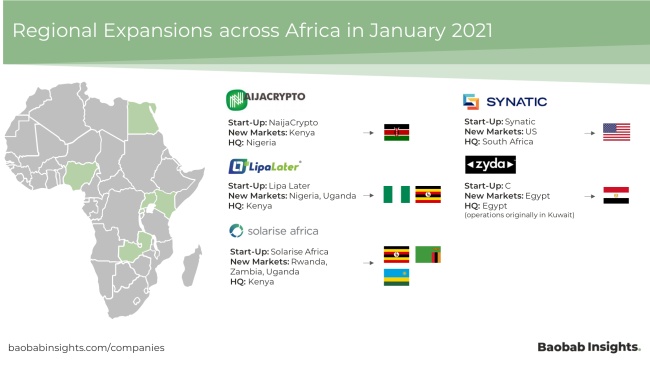

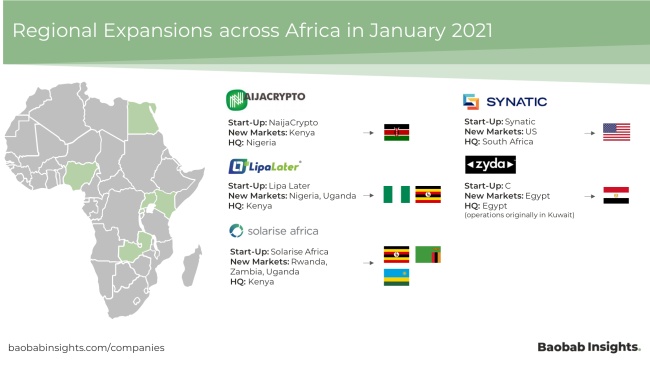

Last week we mapped out the African cryptocurrency landscape, a space which has seen a considerable spike in institutional and retail investment since the beginning of the year. In February NaijaCrypto, a Nigeria-based cryptocurrency exchange, announce the launch of Kenyan Shilling (KES) pairs on their exchange in an effort to build its user base in East Africa.

As seen in the above map, Kenyan-based Solarise Africa, a UV photovoltaics and solar energy leasing company, announced new market expansion plans in Rwanda, Zambia and Uganda after signing a partnership agreement with Centennial Generating Co. This comes after Solarise Africa last year raised $10M in its Series B funding round from Energy Access Ventures, Proparco and Electrification Financing Initiative, bolstering its focus on expansion across Africa.

New Technology Developments: Product Launches and Regional Expansion in February 2021

Venture Capital investment activity in Africa continued a strong start to 2021 this February. In total, $172.66 million was invested into companies across 44 deals (excluding prizes, grants and non-equity assistance), an increase from January 2021 which saw $144.304 million invested across 24 deals.

Notable funding rounds during the month included TymeBank, a South African digital bank providing services through a mobile app and network of smart ATMs, who secured $109 million from Apis Partners and JG Summit Holdings, along with South-African based hearX Group, a HealthTech company that has created smart-phone powered hearing tests, and raised an $8.3 million Series A round.

Despite high levels of investment activity in South Africa during the month, February also included the unexpected announcement that the Section 12 J tax incentive in South Africa was set to end in June 2021.

With such a dynamic month, we took a look at the new product launches and market expansions occurring across Africa.

New Product Launches in February 2021

Are we missing anyone?

Submit Company Announcment

Our 2020 Technology Start-up Funding Report highlighted that the FinTech sector continued its dominance in terms of the number of investment deals and the total sum of investment received last year. February mirrored this high level of activity and innovation in the sector. FinTech companies accounted for 30% of the new product launches mapped. These launches included Spot Money, who have created the South Africa’s first open banking offering that aims to function as a one-stop-single customer-centric platform catering to a variety of user’s needs.

Interestingly, February saw two South-African based companies, Trigger and Aura, both launch products focused on connecting individuals in need with emergency services and security providers. Auru, a WhatsApp enabled security chatbot, connects users with AURA’s nationwide network of over 1,500 armed responders. While Trigger’s innovative app provides real-time access to a network of 220 independent services including; armed response, paramedic, roadside assistance, legal advice, and trauma counselling.

February 2021 Market Expansion and Regional Growth

Are we missing anyone?

Submit Company Announcment

Last week we mapped out the African cryptocurrency landscape, a space which has seen a considerable spike in institutional and retail investment since the beginning of the year. In February NaijaCrypto, a Nigeria-based cryptocurrency exchange, announce the launch of Kenyan Shilling (KES) pairs on their exchange in an effort to build its user base in East Africa.

As seen in the above map, Kenyan-based Solarise Africa, a UV photovoltaics and solar energy leasing company, announced new market expansion plans in Rwanda, Zambia and Uganda after signing a partnership agreement with Centennial Generating Co. This comes after Solarise Africa last year raised $10M in its Series B funding round from Energy Access Ventures, Proparco and Electrification Financing Initiative, bolstering its focus on expansion across Africa.