West Africa Q1 2021 – VC Funding Report

At the end of April, TIME Magazine announced that Flutterwave, a Nigeria-based payments company, was to be featured on their annual list of the 100 most influential companies. The company was featured on their leading “Pioneer’s” list, which also featured amongst others Strava, Oatly, and Beyond Meat. This is a huge achievement for their team, but also serves as yet another milestone achievement for African technology companies. .

This week the team at Flutterwave announced a Partnership with Amole, Ethiopia’s largest mobile Digital Wallet platform, to facilitate money transfer into Ethiopia. The Ethiopia diaspora is estimated to be around 8 million members, and according to recent data collected by the National Bank of Ethiopia, Remittance payments are estimated to be worth around $5 billion USD Annually.

This isn’t the first big announcement of the year to come out of Flutterwave HQ, the team made headlines earlier in 2021 after it joined the Unicorn club (raising $170 million USD in March 2021, placing their value above $1 billion USD). Their founder, Olugbenga Agboola, has since hinted that the company is considering listing on the NYSE.

After a tough year, it is fantastic to see Africa technology companies in the headlines. But have the rest of West Africa’s technology companies started 2021 in such a positive way, we take a look at the Q1 2021 funding trends in more detail.

A positive start to 2021 in West Africa

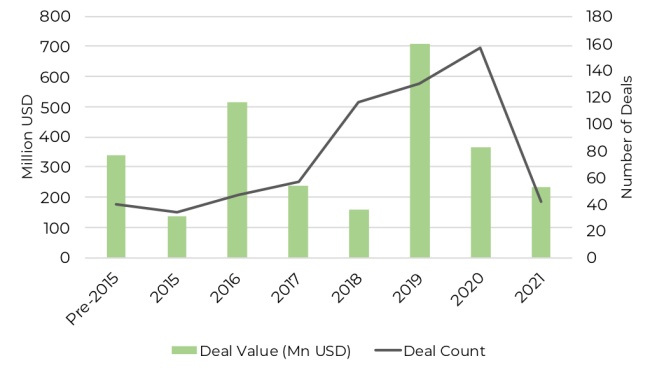

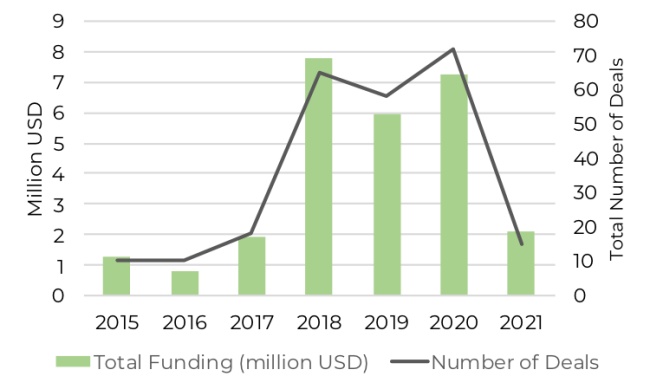

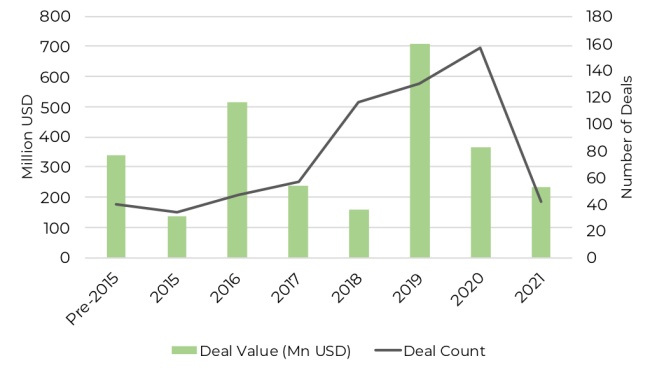

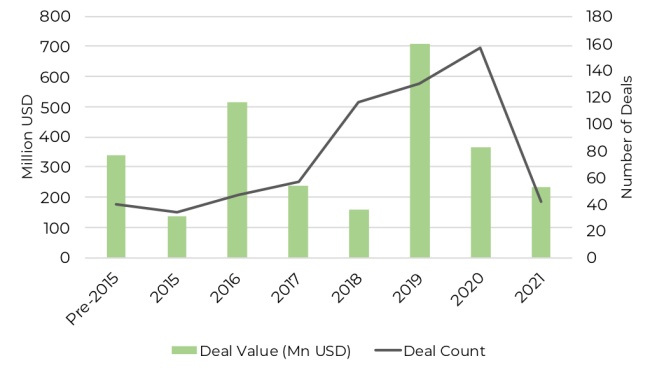

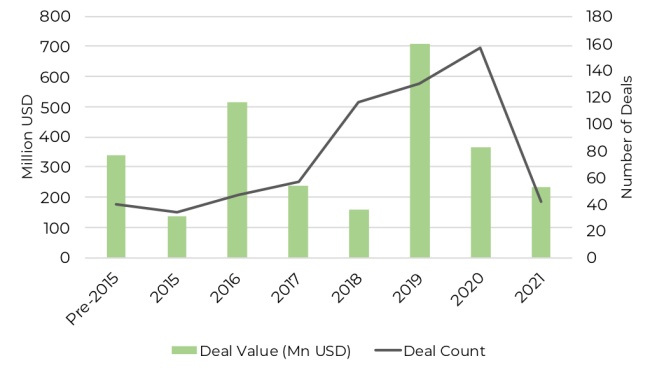

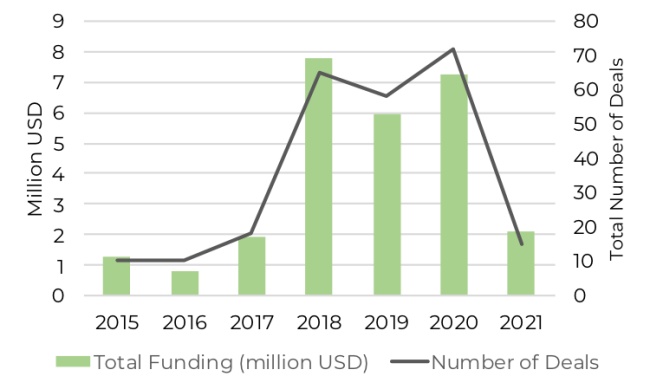

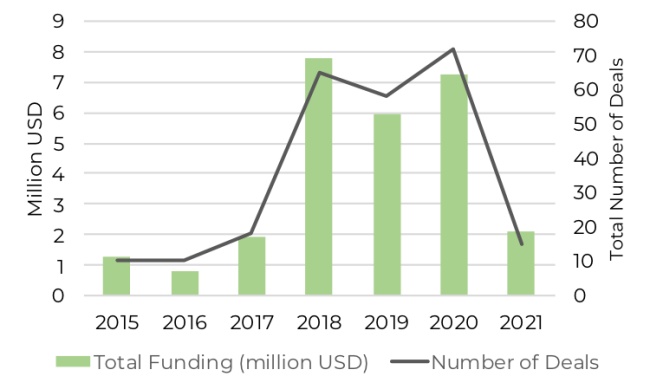

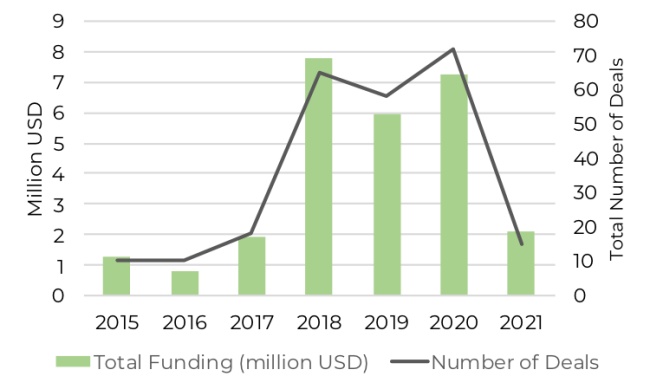

Despite the challenges faced throughout 2020 due to COVID-19, West African technology companies raised $364.2 million USD across 156 deals. This was an increase in the amount raised in 2018 ($158.6 million USD across 116 deals) but a decrease from the 2019 total ($709.1 million USD across 130 deals).

Figure 1: Total investment into West African technology companies since 2015

Source: Baobab Insights, (2021 year to date as of 31/03/2021)

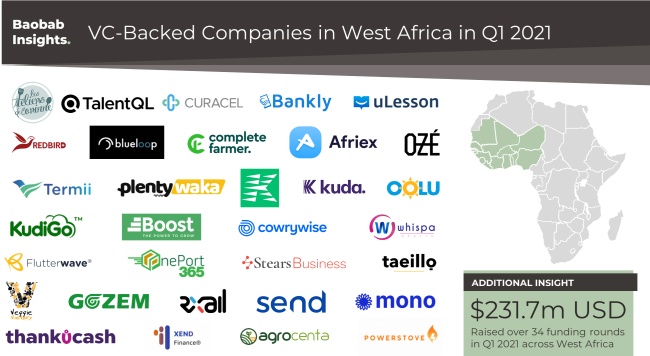

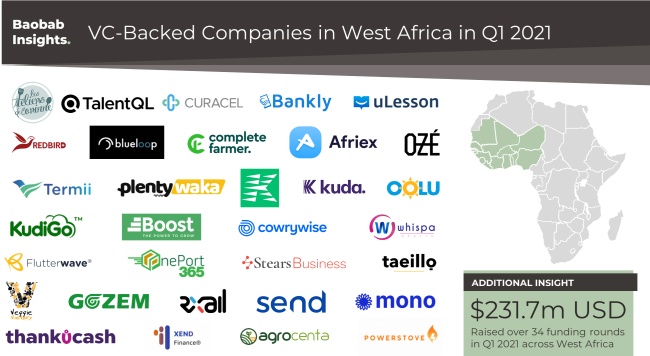

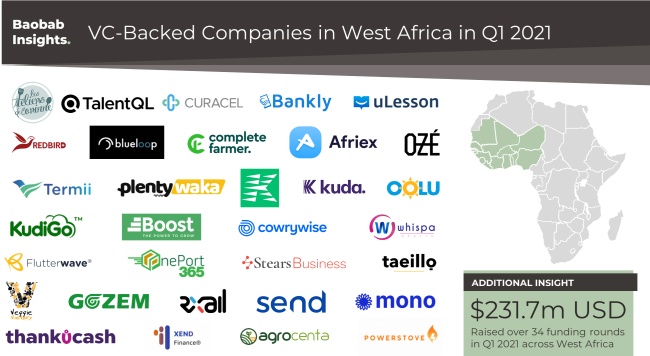

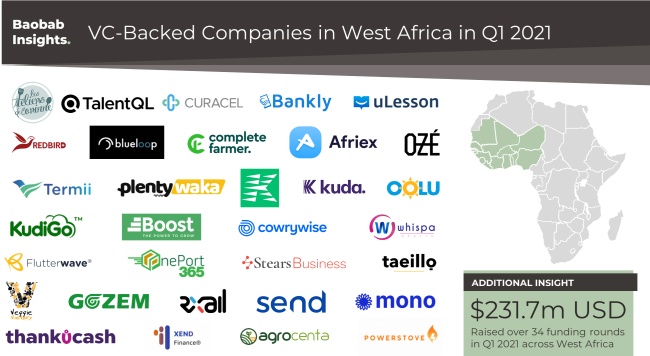

In total, West African start-ups have raised $231.7 million USD across 34 funding rounds in Q1 2021. This is a substantial increase from Q4 2020, in which West Africa start-ups secured $62.2 million USD across 41 funding rounds.

Are we missing anyone?

Submit Start-up

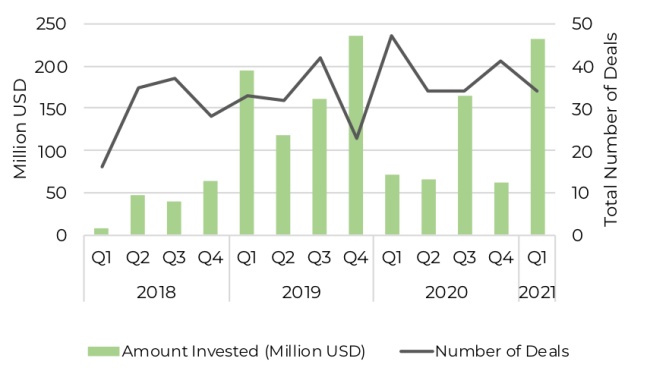

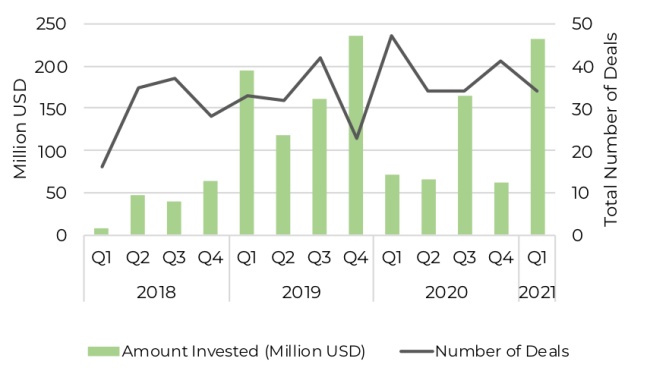

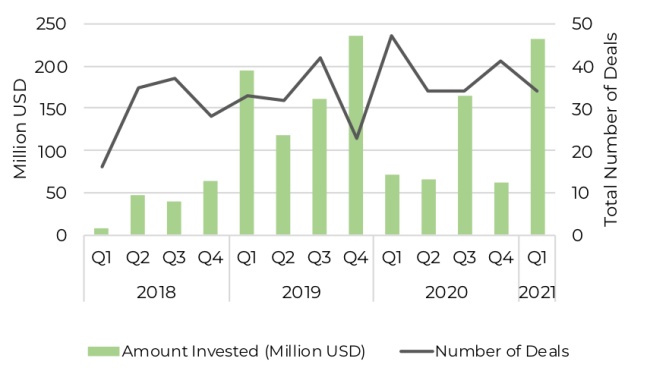

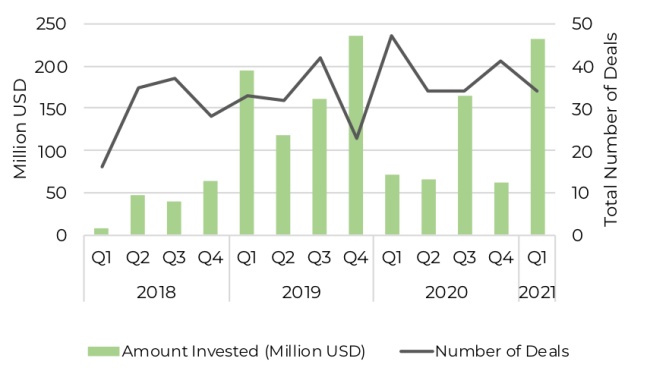

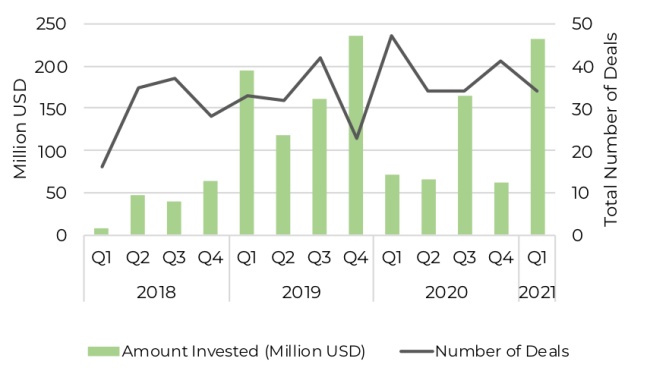

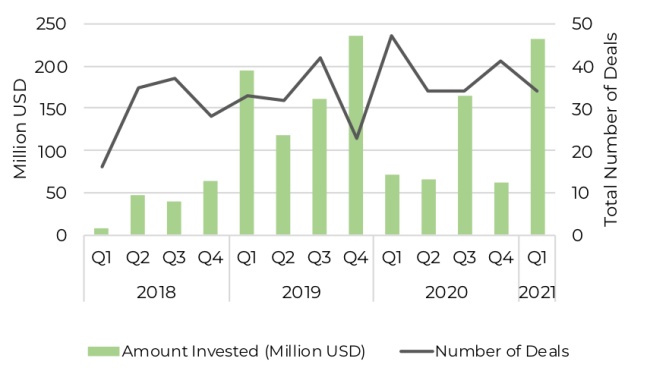

Figure 2: Quarterly funding into West Africa technology companies since 2018

Source: Baobab Insights, (2021 year to date as of 31/03/2021)

However, excluding the $170 million USD Series C secured by Flutterwave, the total closed across remaining funding rounds totalled $61.7 million USD (across 33 funding rounds), which is more comparable to the previous quarter.

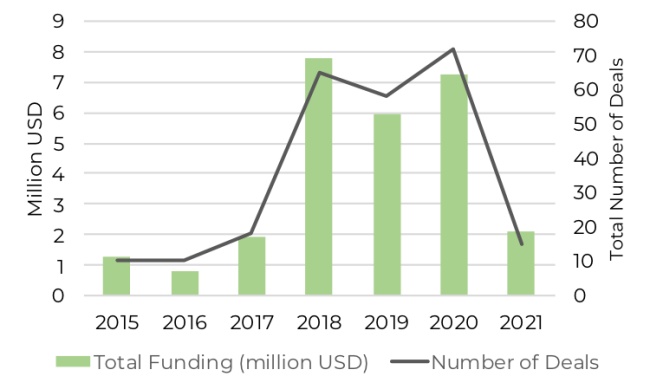

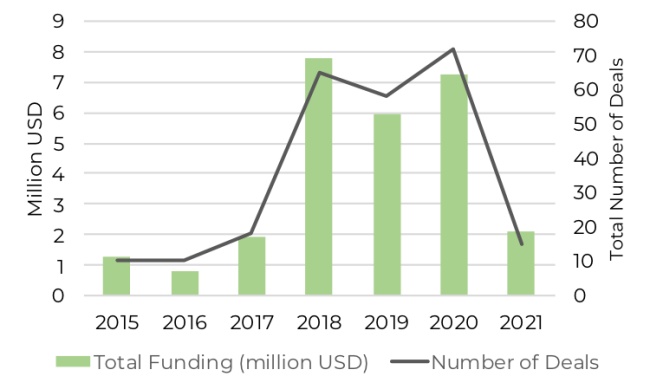

Companies securing early stage funding at the pre-seed or seed stages have had a promising start to the year. In 2019, cumulative funding secured by West African technology companies at the Pre-seed or Seed stage (and where rounds totalled $550,000 USD or less) equalled $5.9 million across 54 funding rounds. In 2020 this figure increased to $7.2 million USD across 72 funding rounds. To date, West Africa technology companies have secured a total of $2.1 million USD across 15 pre-seed or seed stage funding rounds in Q1 2021.

Figure 3: Annual investment into pre-seed or seed stage companies across West Africa since 2015

West Africa FinTech still attractive

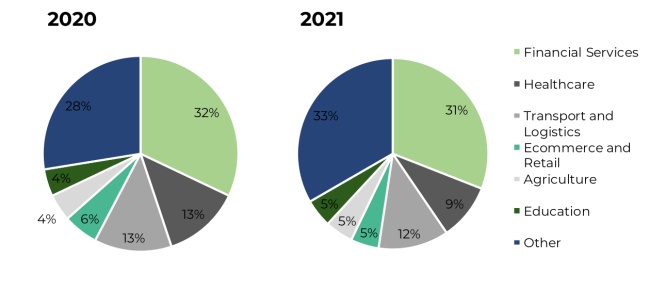

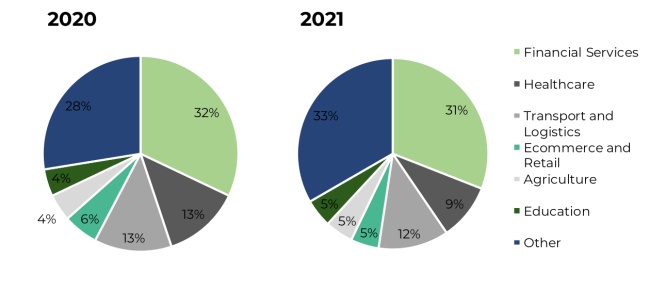

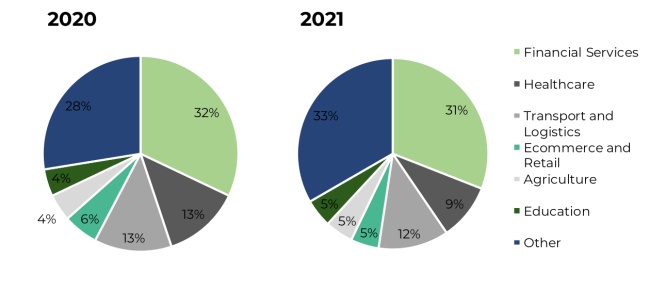

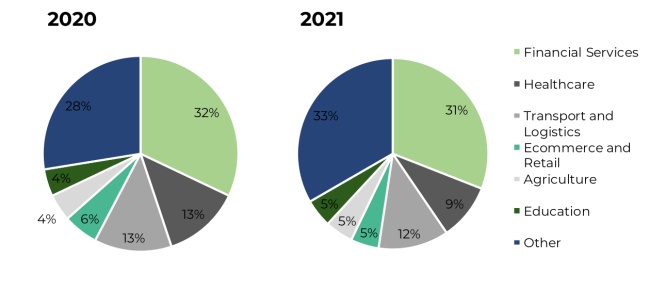

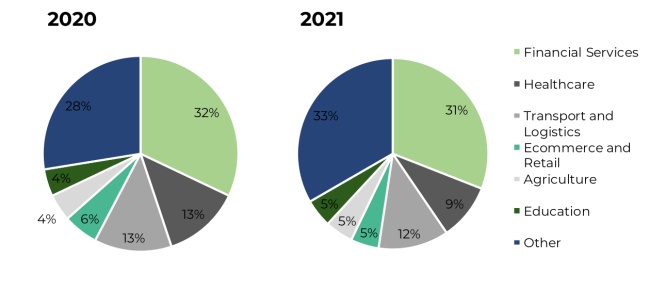

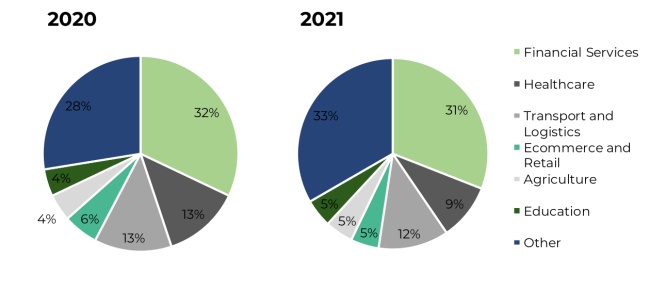

FinTech deals in West Africa continue to attract investor attention. In 2019 FinTech deals accounted for 24% of all funding rounds across the whole of Africa. In West Africa FinTech accounted for 32% of deals. In 2020, the proportion of FinTech deals dropped to 22% of funding across the whole of Africa, while in West Africa the proportion of FinTech deals remained unchanged at 32%. In Q1 2021, the proportion of FinTech funding has dropped slightly to 31% in West Africa, in comparison to 28% of deals across the whole of Africa.

Figure 4: Proportion of funding rounds by sector in West Africa in 2020 and 2021

While HealthTech and Logistics Technology both saw a slight increase in the proportion of funding rounds secured between 2019 and 2020, both sectors have seen a slight reduction in the proportion of funding rounds between 2020 and 2021. The proportion of funding rounds secured by HealthTech companies in the West Africa region decreased from 13% of funding rounds to 9%. West Africa’s transport and logistics companies saw a more modest reduction in the proportion of funding rounds closed, decreasing from 13% to 12% between 2020 and 2021.

West Africa start-ups secure larger early stage funding rounds?

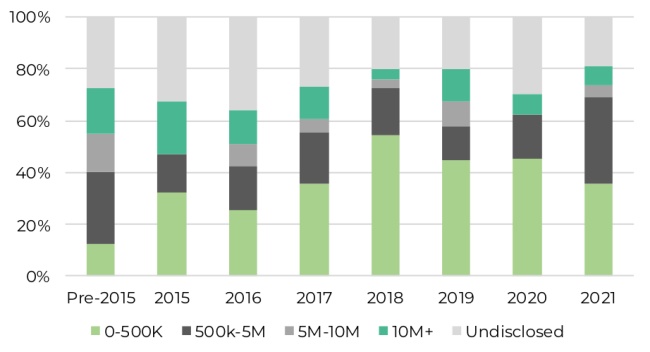

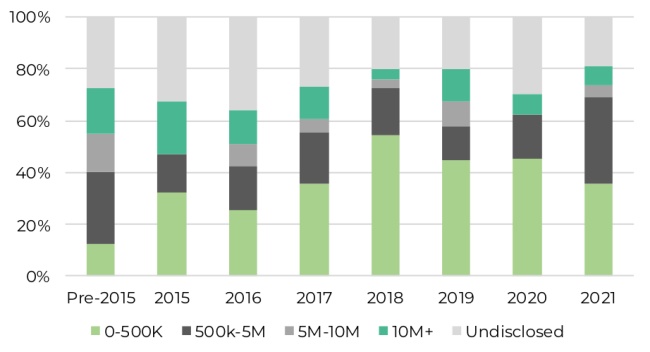

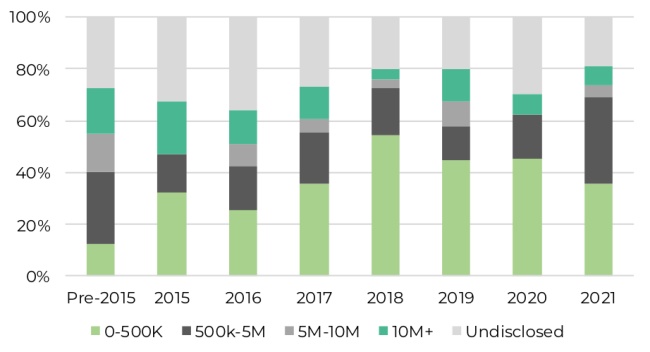

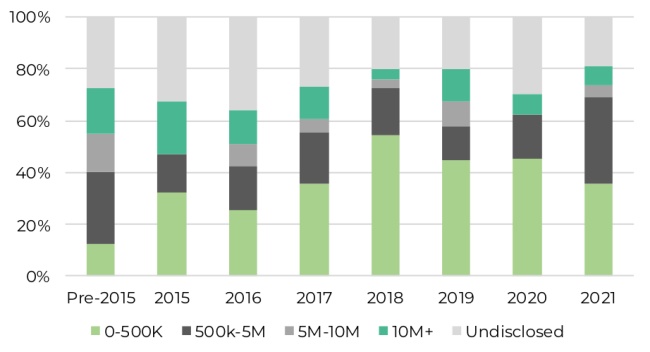

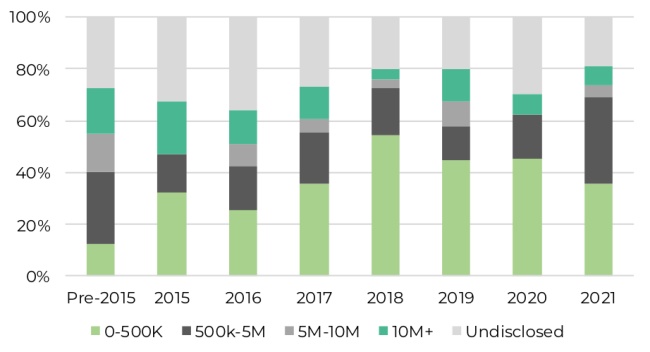

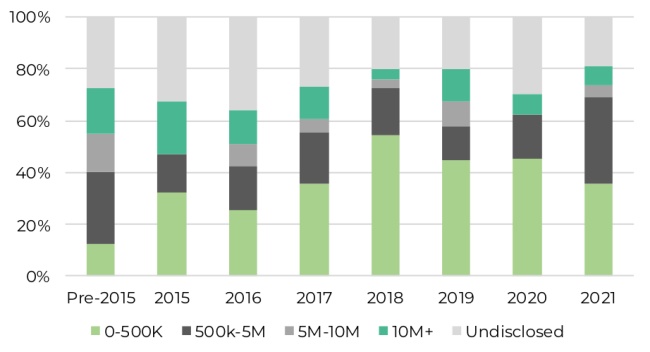

While the total number of West Africa deals and the amount invested has increased, we have also seen a corresponding change in the size of ticket favoured by investors. The proportion of funding rounds totalling $500k USD or less has decreased year on year since 2018. In 2018 it represented 54% of total deals, whereas only 36% of deals in 2021 totalled $500k or less. The proportion of deals totalling $500k to $5million USD has increased from 18% of total deals in 2018 to 33% of total deals.

Figure 5: Proportion of funding rounds closed by West African technology companies by disclosed ticket size since 2015

A new generation of West African technology companies

West Africa technology start-ups have had a positive start to the year both in terms of funding and number of deals closed. While funding levels have yet to return to those seen in 2019, the increasing number of larger size deals is perhaps an indication of a maturing ecosystem featuring a large frequency of later stage funding rounds.

That said, since 2018 the increasing number of pre-seed or seed stage funding rounds perhaps gives an indication of a growing generation of start-ups that are already hot on the heels of the Flutterwave team.

West Africa Q1 2021 – VC Funding Report

At the end of April, TIME Magazine announced that Flutterwave, a Nigeria-based payments company, was to be featured on their annual list of the 100 most influential companies. The company was featured on their leading “Pioneer’s” list, which also featured amongst others Strava, Oatly, and Beyond Meat. This is a huge achievement for their team, but also serves as yet another milestone achievement for African technology companies. .

This week the team at Flutterwave announced a Partnership with Amole, Ethiopia’s largest mobile Digital Wallet platform, to facilitate money transfer into Ethiopia. The Ethiopia diaspora is estimated to be around 8 million members, and according to recent data collected by the National Bank of Ethiopia, Remittance payments are estimated to be worth around $5 billion USD Annually.

This isn’t the first big announcement of the year to come out of Flutterwave HQ, the team made headlines earlier in 2021 after it joined the Unicorn club (raising $170 million USD in March 2021, placing their value above $1 billion USD). Their founder, Olugbenga Agboola, has since hinted that the company is considering listing on the NYSE.

After a tough year, it is fantastic to see Africa technology companies in the headlines. But have the rest of West Africa’s technology companies started 2021 in such a positive way, we take a look at the Q1 2021 funding trends in more detail.

A positive start to 2021 in West Africa

Despite the challenges faced throughout 2020 due to COVID-19, West African technology companies raised $364.2 million USD across 156 deals. This was an increase in the amount raised in 2018 ($158.6 million USD across 116 deals) but a decrease from the 2019 total ($709.1 million USD across 130 deals).

Figure 1: Total investment into West African technology companies since 2015

Source: Baobab Insights, (2021 year to date as of 31/03/2021)

In total, West African start-ups have raised $231.7 million USD across 34 funding rounds in Q1 2021. This is a substantial increase from Q4 2020, in which West Africa start-ups secured $62.2 million USD across 41 funding rounds.

Are we missing anyone?

Submit Start-up

Figure 2: Quarterly funding into West Africa technology companies since 2018

Source: Baobab Insights, (2021 year to date as of 31/03/2021)

However, excluding the $170 million USD Series C secured by Flutterwave, the total closed across remaining funding rounds totalled $61.7 million USD (across 33 funding rounds), which is more comparable to the previous quarter.

Companies securing early stage funding at the pre-seed or seed stages have had a promising start to the year. In 2019, cumulative funding secured by West African technology companies at the Pre-seed or Seed stage (and where rounds totalled $550,000 USD or less) equalled $5.9 million across 54 funding rounds. In 2020 this figure increased to $7.2 million USD across 72 funding rounds. To date, West Africa technology companies have secured a total of $2.1 million USD across 15 pre-seed or seed stage funding rounds in Q1 2021.

Figure 3: Annual investment into pre-seed or seed stage companies across West Africa since 2015

West Africa FinTech still attractive

FinTech deals in West Africa continue to attract investor attention. In 2019 FinTech deals accounted for 24% of all funding rounds across the whole of Africa. In West Africa FinTech accounted for 32% of deals. In 2020, the proportion of FinTech deals dropped to 22% of funding across the whole of Africa, while in West Africa the proportion of FinTech deals remained unchanged at 32%. In Q1 2021, the proportion of FinTech funding has dropped slightly to 31% in West Africa, in comparison to 28% of deals across the whole of Africa.

Figure 4: Proportion of funding rounds by sector in West Africa in 2020 and 2021

While HealthTech and Logistics Technology both saw a slight increase in the proportion of funding rounds secured between 2019 and 2020, both sectors have seen a slight reduction in the proportion of funding rounds between 2020 and 2021. The proportion of funding rounds secured by HealthTech companies in the West Africa region decreased from 13% of funding rounds to 9%. West Africa’s transport and logistics companies saw a more modest reduction in the proportion of funding rounds closed, decreasing from 13% to 12% between 2020 and 2021.

West Africa start-ups secure larger early stage funding rounds?

While the total number of West Africa deals and the amount invested has increased, we have also seen a corresponding change in the size of ticket favoured by investors. The proportion of funding rounds totalling $500k USD or less has decreased year on year since 2018. In 2018 it represented 54% of total deals, whereas only 36% of deals in 2021 totalled $500k or less. The proportion of deals totalling $500k to $5million USD has increased from 18% of total deals in 2018 to 33% of total deals.

Figure 5: Proportion of funding rounds closed by West African technology companies by disclosed ticket size since 2015

A new generation of West African technology companies

West Africa technology start-ups have had a positive start to the year both in terms of funding and number of deals closed. While funding levels have yet to return to those seen in 2019, the increasing number of larger size deals is perhaps an indication of a maturing ecosystem featuring a large frequency of later stage funding rounds.

That said, since 2018 the increasing number of pre-seed or seed stage funding rounds perhaps gives an indication of a growing generation of start-ups that are already hot on the heels of the Flutterwave team.