AgTech Investment 2020 – Africa Market Map

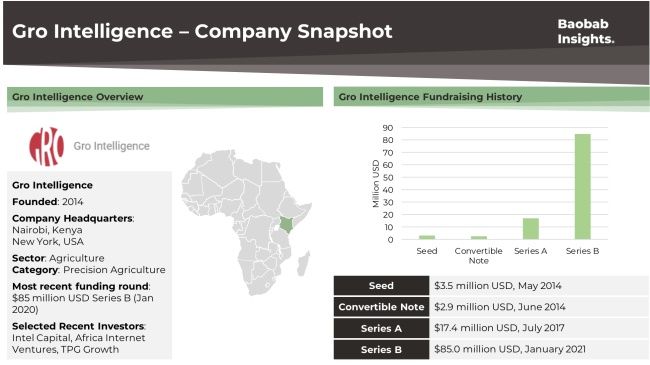

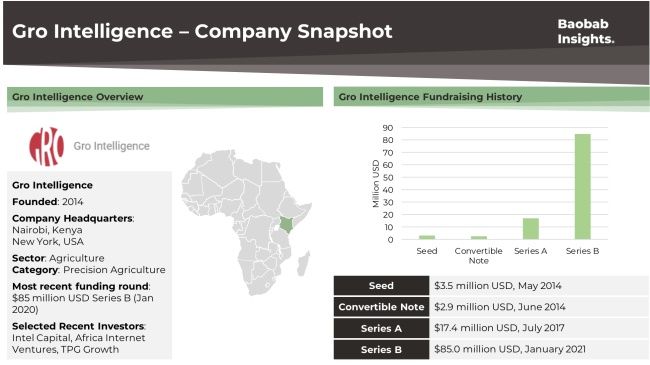

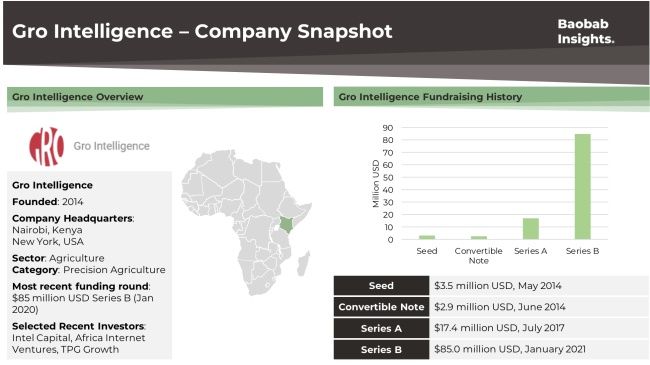

In January 2021, Gro Intelligence a US and Kenya-based AgTech company announced that it had closed $85 million USD in Series B funding. The round, which was co-led by Intel Capital, Africa Internet Ventures and the family offices of Ronald Lauder and Eric Zinterhofer, is more evidence of the growing role digital technologies are playing in the food value chain.

Gro Intelligence leverages satellite imagery, remote sensors and machine learning technology to provide analytical data to; Agribusinesses, food and beverage companies and farm input suppliers. So, does this more analytical approach represent the future of Africa’s farming industries?

Source: Baobab Insights, (2020 year to date as of 08/02/2021)

Data Driven Agriculture

In July 2020, Komaza, a Tech-enabled forestry company announced that it had closed a $28 million USD in a Series B raise co-led by AXA Investment Partners (through the AXA Impact Fund) and Dutch development bank FMO.

The company uses a distributed “microforestry” model, unlocking land used by smallholder farmers thereby moving the forestry industry away from large costly plantations. Focusing on partnerships with local farmers creates operational complexity, but the team overcomes these challenges using technology such AI and satellite imagery to aid their planning and coordination processes. These larger, early stage investment in the likes of Gro Intelligence and Komaza perhaps highlight the potential investors see in technologies such as AI to impact complex and often dispersed food value chains across Africa.

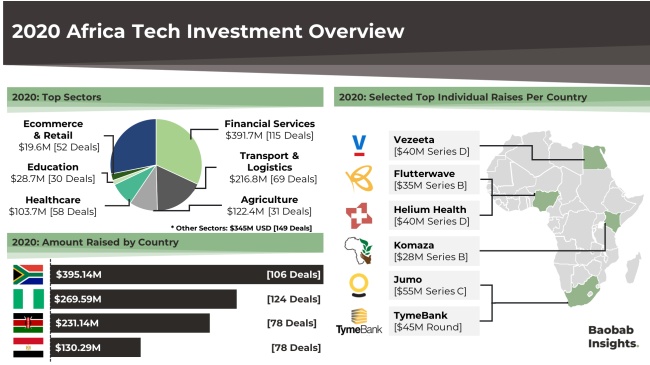

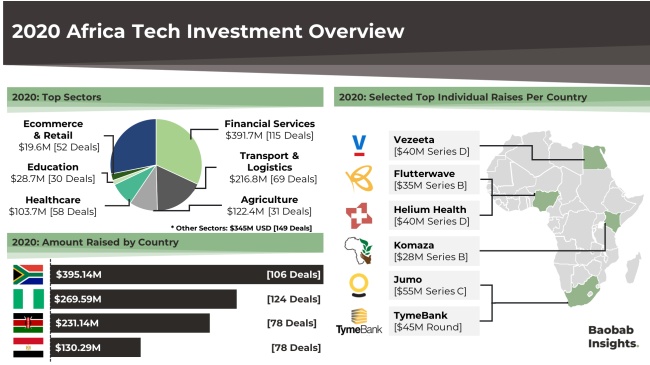

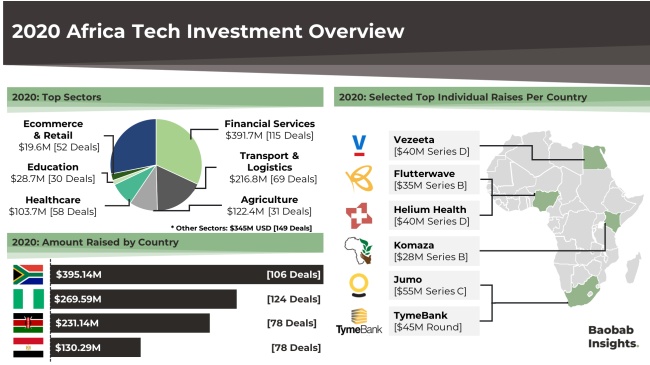

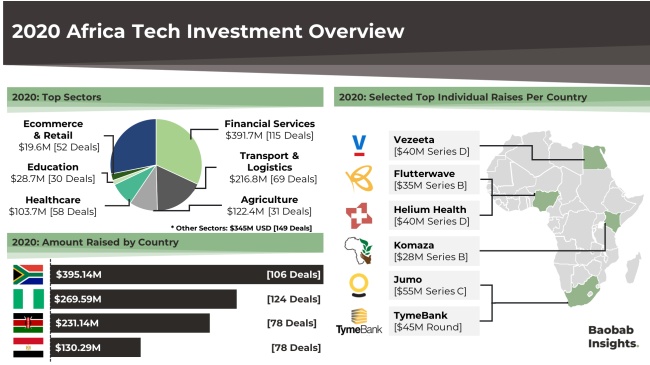

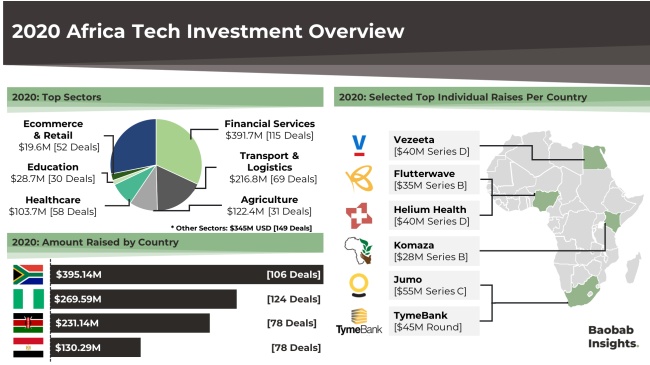

Analysis from our 2020 funding report indicated that the Agriculture sector saw an increase in investor attention from the previous year. In fact, AgTech companies closed 10% of total funding across all sectors in 2020. In this report, we take a look companies innovating along Africa’s agricultural value chains.

Growth in AgTech Investment

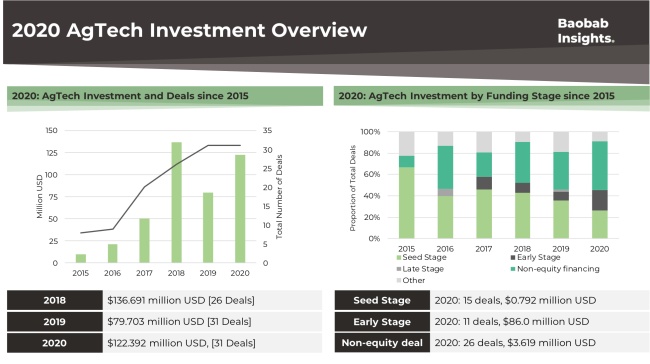

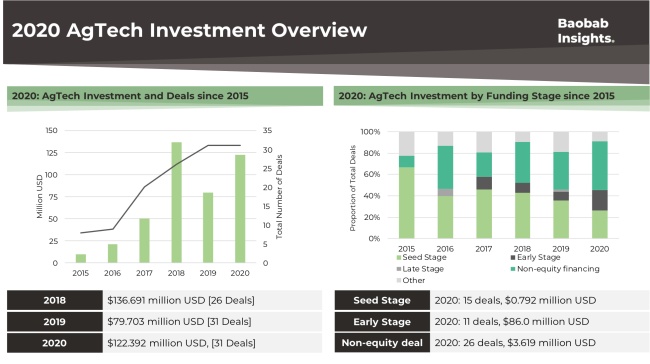

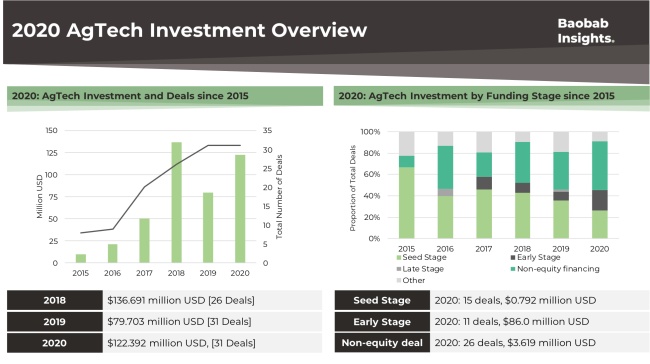

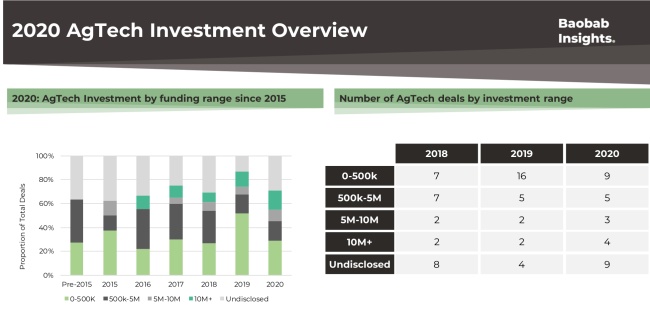

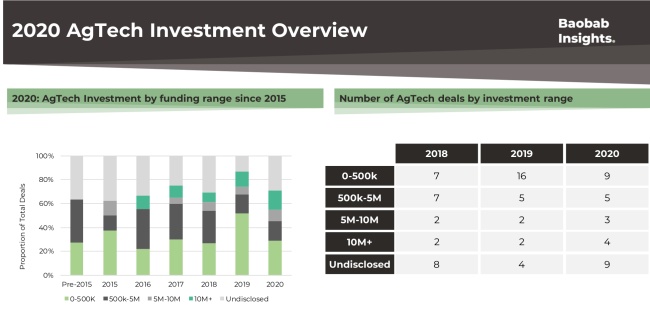

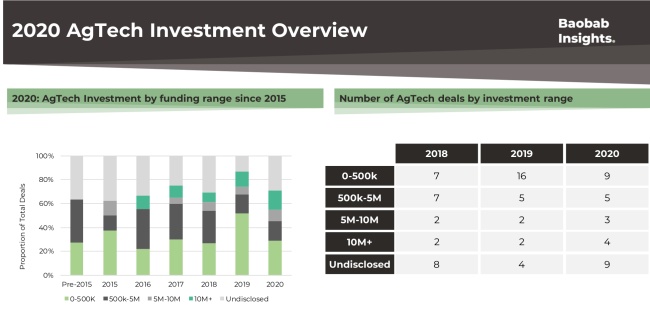

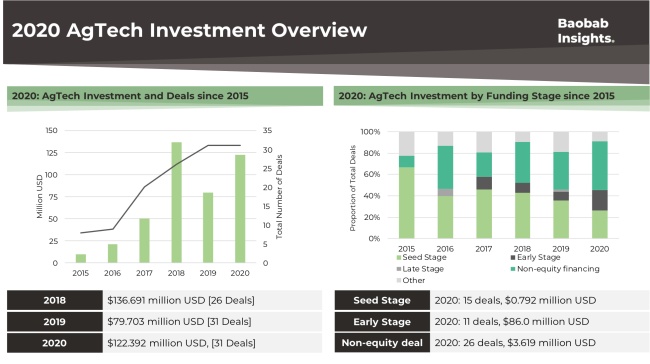

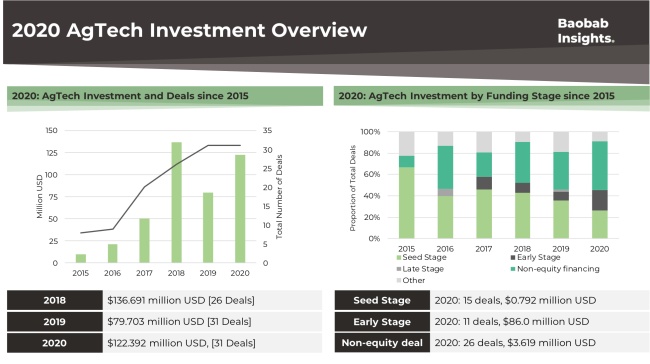

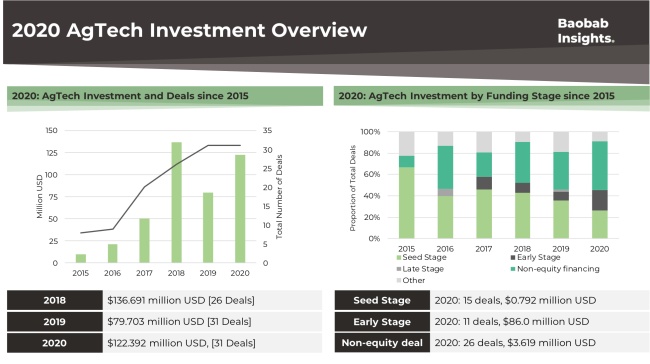

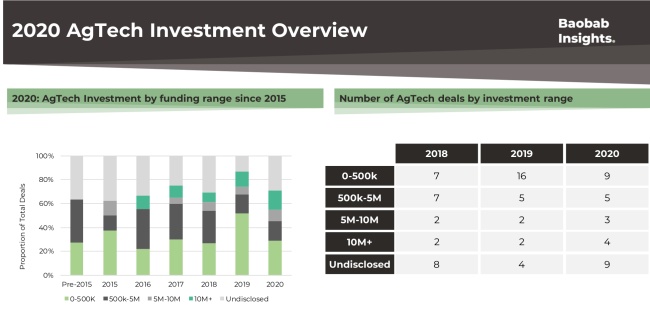

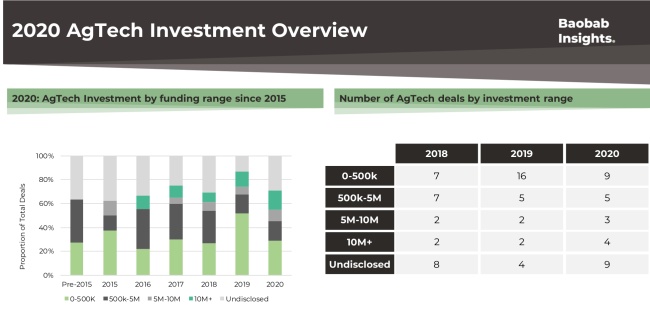

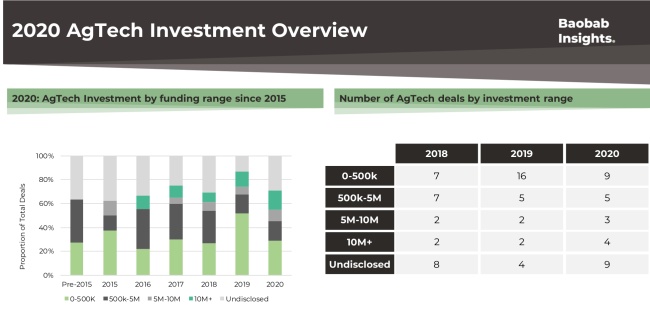

According to Baobab Insights data, AgTech companies secured a $122.392 million USD across 31 funding rounds in 2020, increasing from $79.703 million USD in 2019. In addition to this there were a total of 23 non-equity funding rounds closed, which amounted to $3.619 million USD (which includes prizes, grants and other non-equity financial assistance).

The total number of Seed stage funding rounds remained unchanged between 2019 and 2020 (13 Seed stage rounds announced in each year). The number of early stage funding rounds (Series A and Series B funding stages) saw growth from $29.23 million USD across 4 funding rounds in 2019 to $86.0 million USD across 11 funding rounds in 2020.

Source: Baobab Insights, (2020 year to date as of 08/02/2021)

Additionally, the number of rounds totalling $500,000 USD or less dropped from 16 in 2019 to 9 in 2020. While the number of rounds totalling $5.0 million USD and above increased from 3 to 8 between 2019 and 2020.

It is too early to tell if we will see a continuation of this investment trend; but in addition to Gro Intelligence, the AgTech sector has had a busy start to 2021. Tunisia’s MooMe, Ghana’s AgroCenta and South Africa’s 3DIMO all announcing funding in January.

Source: Baobab Insights, (2020 year to date as of 08/02/2021)

Is AI enabled Agriculture the future?

Existential issues such as climate change and food security are often cited as the big challenges being tackled by data driven approaches. But while precision agriculture companies are increasingly putting a raft of tools into the hands of the farmer, there is still a crucial need to marry this with traditional techniques.

Source: Baobab Insights, (2020 year to date as of 08/02/2021)

Are we missing anyone?

Submit Startup

Companies such as SunCulture, who raised a $14.0 million USD Series A round led by Energy Access Ventures in December 2020, use artificial intelligence and IoT technology to support intelligent irrigation systems. Likewise, SwiftVEE, a South Africa-based AI-powered AgTech raised a $1.5 million USD Series A led by Subtropico to support the expansion of the livestock auction service. These services are both solving critical challenges related to productivity, and access to market working alongside farmers and agribusinesses.

In a recent Baobab Insights report, Nneile Nkholise, co-founder of 3DIMO, an AI-powered AgTech explains why the technology is so important; “we are building a Facebook for animals around the world. Our aim is to build an extensive database of information on animal health, allowing for us to track trends in disease outbreak and to trace animal ownership.”

The 3DIMO team use biometrics and artificial intelligence to detect disease as well as provide a unique identifier for each animal, Nneile goes on to explain, “We want to create transparency and provide rich data insights in an industry that has mostly been fragmented”.

In Africa, AgTech solutions need to work across complex value chains and in a variety of settings. And while global challenges such as food security, deforestation and climate change will continue to make headlines, for AgTech founders solving these, begins with putting powerful tools in the hands of the farmer.

FREE ACCESS: Download 5 page Africa AgTech Funding Report

Download Funding Report

FREE ACCESS: Download 5 page Africa AgTech Funding Report

Download Market Map

Contact the authors for more information about our Insight

AgTech Investment 2020 – Africa Market Map

In January 2021, Gro Intelligence a US and Kenya-based AgTech company announced that it had closed $85 million USD in Series B funding. The round, which was co-led by Intel Capital, Africa Internet Ventures and the family offices of Ronald Lauder and Eric Zinterhofer, is more evidence of the growing role digital technologies are playing in the food value chain.

Gro Intelligence leverages satellite imagery, remote sensors and machine learning technology to provide analytical data to; Agribusinesses, food and beverage companies and farm input suppliers. So, does this more analytical approach represent the future of Africa’s farming industries?

Source: Baobab Insights, (2020 year to date as of 08/02/2021)

Data Driven Agriculture

In July 2020, Komaza, a Tech-enabled forestry company announced that it had closed a $28 million USD in a Series B raise co-led by AXA Investment Partners (through the AXA Impact Fund) and Dutch development bank FMO.

The company uses a distributed “microforestry” model, unlocking land used by smallholder farmers thereby moving the forestry industry away from large costly plantations. Focusing on partnerships with local farmers creates operational complexity, but the team overcomes these challenges using technology such AI and satellite imagery to aid their planning and coordination processes. These larger, early stage investment in the likes of Gro Intelligence and Komaza perhaps highlight the potential investors see in technologies such as AI to impact complex and often dispersed food value chains across Africa.

Analysis from our 2020 funding report indicated that the Agriculture sector saw an increase in investor attention from the previous year. In fact, AgTech companies closed 10% of total funding across all sectors in 2020. In this report, we take a look companies innovating along Africa’s agricultural value chains.

Growth in AgTech Investment

According to Baobab Insights data, AgTech companies secured a $122.392 million USD across 31 funding rounds in 2020, increasing from $79.703 million USD in 2019. In addition to this there were a total of 23 non-equity funding rounds closed, which amounted to $3.619 million USD (which includes prizes, grants and other non-equity financial assistance).

The total number of Seed stage funding rounds remained unchanged between 2019 and 2020 (13 Seed stage rounds announced in each year). The number of early stage funding rounds (Series A and Series B funding stages) saw growth from $29.23 million USD across 4 funding rounds in 2019 to $86.0 million USD across 11 funding rounds in 2020.

Source: Baobab Insights, (2020 year to date as of 08/02/2021)

Additionally, the number of rounds totalling $500,000 USD or less dropped from 16 in 2019 to 9 in 2020. While the number of rounds totalling $5.0 million USD and above increased from 3 to 8 between 2019 and 2020.

It is too early to tell if we will see a continuation of this investment trend; but in addition to Gro Intelligence, the AgTech sector has had a busy start to 2021. Tunisia’s MooMe, Ghana’s AgroCenta and South Africa’s 3DIMO all announcing funding in January.

Source: Baobab Insights, (2020 year to date as of 08/02/2021)

Is AI enabled Agriculture the future?

Existential issues such as climate change and food security are often cited as the big challenges being tackled by data driven approaches. But while precision agriculture companies are increasingly putting a raft of tools into the hands of the farmer, there is still a crucial need to marry this with traditional techniques.

Source: Baobab Insights, (2020 year to date as of 08/02/2021)

Are we missing anyone?

Submit Startup

Companies such as SunCulture, who raised a $14.0 million USD Series A round led by Energy Access Ventures in December 2020, use artificial intelligence and IoT technology to support intelligent irrigation systems. Likewise, SwiftVEE, a South Africa-based AI-powered AgTech raised a $1.5 million USD Series A led by Subtropico to support the expansion of the livestock auction service. These services are both solving critical challenges related to productivity, and access to market working alongside farmers and agribusinesses.

In a recent Baobab Insights report, Nneile Nkholise, co-founder of 3DIMO, an AI-powered AgTech explains why the technology is so important; “we are building a Facebook for animals around the world. Our aim is to build an extensive database of information on animal health, allowing for us to track trends in disease outbreak and to trace animal ownership.”

The 3DIMO team use biometrics and artificial intelligence to detect disease as well as provide a unique identifier for each animal, Nneile goes on to explain, “We want to create transparency and provide rich data insights in an industry that has mostly been fragmented”.

In Africa, AgTech solutions need to work across complex value chains and in a variety of settings. And while global challenges such as food security, deforestation and climate change will continue to make headlines, for AgTech founders solving these, begins with putting powerful tools in the hands of the farmer.